Russia’s central bank switched from being a net seller of gold to a net buyer in 2006 and has amassed one of the largest stockpiles in the world. The gold reserves are part of Putin’s plan to construct a “fortress Russia” economy impervious to sanctions, ‘The Telegraph’ writes.

Putin’s ploy has paid off handsomely in recent weeks after a surge in the price of bullion. Gold surged past $4,000 an ounce for the first time on Wednesday, taking its gains so far this year over 50pc. The rally values Russia’s 2,326.5-tonne hoard at just over $302bn (£225bn).

The most recent rally has been driven by concerns about a bubble in artificial intelligence (AI) stocks, worries about the US government shutdown and he unexpected resignation of France’s prime minister Sébastien Lecornu.

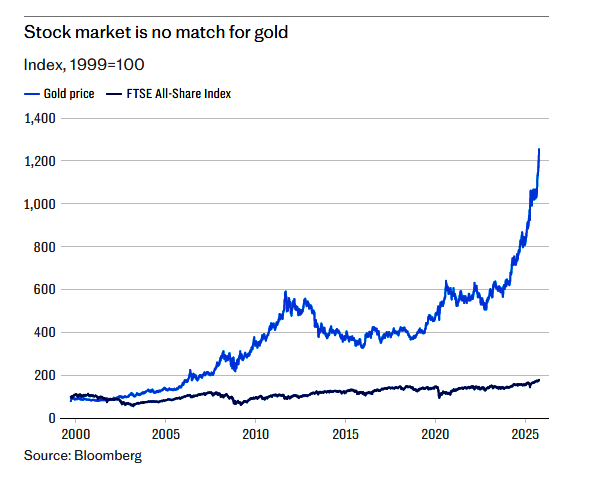

Yet the price of gold has enjoyed a meteoric rise in recent years. It has doubled since the end of 2023 and rocketed 841pc since the start of 2006, when Russia began building its stockpile.

Gold is traditionally considered a safe haven in times of turmoil. Ewa Manthey, a commodities strategist at ING, said its “historic rally” had been spurred by conflicts in the Middle East and Ukraine. Its price has surged by 111pc since Putin’s invasion in February 2022.

“The move higher in gold has been driven by two forces, firstly the significant increase in central bank purchases since the Ukraine conflict and secondly a more recent drive from retail investors, where we’ve seen a significant increase of flows into ETFs [exchange traded funds], for example,” says Eren Osman, of private bank Arbuthnot Latham.

The Ukraine war is one of numerous crises that have swept the world in recent years, ranging from the pandemic to Donald Trump’s trade war and concerns about rising government debt levels.

“Funds and global reserve managers want a hedge against fiscal recklessness, currency debasement, and unpredictable government policy, and gold sits squarely at the heart of that movement,” says Chris Weston, an analyst at broker Pepperstone.

Gold has also surged as interest rates begin to fall around the world following a period of steep increases in the aftermath of the pandemic. Investors widely expect the US Federal Reserve to cut interest rates this month. Lower rates weaken the dollar, making it cheaper for buyers of gold who do not use the US currency.

Tai Wong, an independent metals trader, told Reuters: “There’s so much faith in this trade right now that the market will look for the next big round number, which is 5,000, with the Fed likely to continue to lower rates.

“There will be some bumps in the road, like a lasting truce in the Middle East or Ukraine, but the fundamental drivers of the trade, massive and growing debt, reserve diversification, and a weaker dollar are unlikely to change in the medium term.”

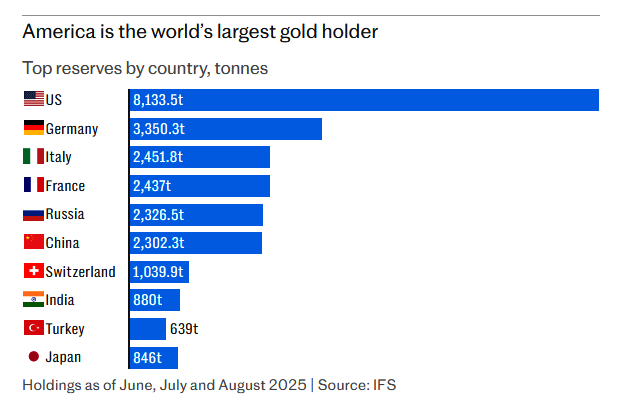

Russia has by no means been the only beneficiary of gold’s price surge. China has also hugely boosted its reserves in recent years and has the seventh largest hoard in the world.

Meanwhile, the US remains the world’s largest gold holder with 8,133 tonnes, now valued at $1.04tn (£776bn). It is the first time any nation’s reserves have surpassed the one trillion US dollar threshold.

America is the world’s largest gold holder:

Britain’s stockpile is pitifully small by comparison. The Bank of England holds 310.3 tonnes of gold in its reserves, worth around $40.1bn. Its haul could have been worth much more but for Gordon Brown’s decision as chancellor in 1999 to sell half of Britain’s reserves, fetching just $3.5bn by 2002.

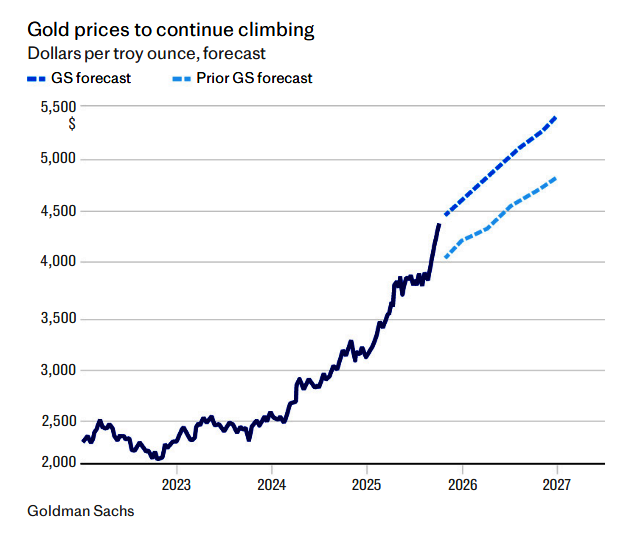

Goldman Sachs this week forecast bullion would reach $4,900 an ounce by December next year, up from its previous estimate of $4,300. It expects this 23pc rally to largely be fuelled by central banks, with emerging markets particularly “likely to continue the structural diversification of their reserves into gold”.

Osman, of Arbuthnot Latham, adds that gold has “broken away from many of its long-term fundamental relationships”, suggesting the market may be acting irrationally. “Its extended rally this year could quite easily be met with a near-term correction,” he says.

read more in our Telegram-channel https://t.me/The_International_Affairs

11:47 14.10.2025 •

11:47 14.10.2025 •