A new poll has found that almost half of all Americans with credit-card debt are concerned over their ability to pay it back, writes Newsweek.

The poll, conducted by Redfield and Wilton Strategies exclusively for Newsweek, found that 46 percent of Americans with credit cards are either "very" or "fairly" concerned over paying back their spending debts. The survey was conducted on December 8 with a sample size of 1,500 people living in the U.S.

The polling comes after it was revealed in August that Americans owe a staggering combined $1 trillion in credit-card debt, according to data reported from the Federal Reserve Bank of New York. Debt owed to credit-card agencies increased by $45 billion, or 4.6 percent, between April and June alone.

The survey found that 28 percent of Americans sampled are "very concerned" with their ability to pay back their credit. Those who said they were "fairly concerned" came in at 18 percent, whereas those who are "slightly concerned" was found to be 19 percent. Of those polled, 36 percent said they were "not at all" concerned over credit-card debt.

Redfield and Wilton Strategies also found that 28 percent of Americans have one credit card in their name, with 25 percent having two, and 12 percent having three cards. Americans with more than three credit cards was recorded at 13 percent, up from 11 percent in the last survey conducted on May 31 this year.

When credit-card holders were asked if they thought their debt would increase over the Christmas and New Year period, 39 percent agreed, while 41 percent said their credit bills would likely stay the same. Only 14 percent said they believed their debt would decrease, whereas 6 percent said they didn't know.

Experts have said the rise in credit-card dues comes down to high inflation. Dan Casey, investment adviser representative at Bridgeriver Advisors in Michigan, told Newsweek: "I believe credit-card debt has reached record-breaking levels due to persistent inflation.

"Inflation has caused increased financial pressure, and many are struggling to keep up with the cost of living," Casey said. "This has caused many people to fall behind on their payments, forcing them to carry a balance over to the next month. Late fees and high interest rates on credit cards only add to the difficulty of getting them paid off."

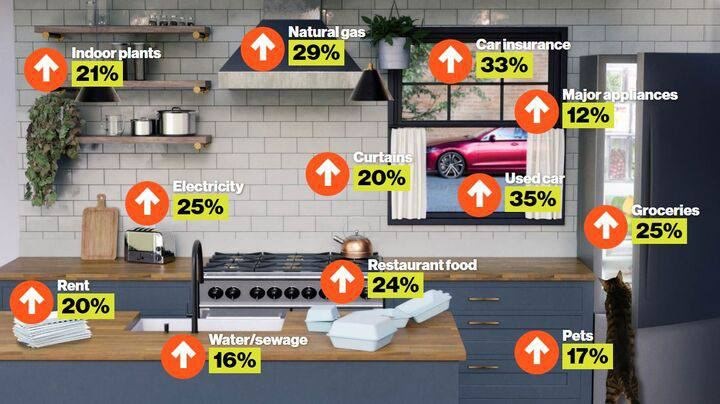

This is how prices have increased in the USA lately:

A person paying with a credit card close-up. Debt owed to credit-card agencies increased by $45 billion, or 4.6 percent, between April and June alone. GETTY

In the period where the Federal Reserve Bank of New York recorded the $45 billion increase, inflation stood at around 4 percent, according to the Bureau of Labor Statistics.

"In the short term, I do believe the concern over credit-card debt will continue to rise," Casey added. "Last year, inflation was higher than it has been over the past 40 years. The national APR on credit cards has also been steadily increasing."

However, Casey said that, as inflation decreases, Americans are likely to feel more relieved and claw back the ability to pay their credit-card debts. "The past few years, the APR was stable around 15 percent; now the average is closer to 22 percent," he added.

"However, as inflation starts to ease, we can expect Americans to be under less financial stress and therefore have the ability to pay back their credit-card debt."

read more in our Telegram-channel https://t.me/The_International_Affairs

10:12 22.12.2023 •

10:12 22.12.2023 •