Slogans against circumstances

Photo: AFP

US manufacturing ended 2025 with a thud, capping a rough year for the sector. To recap, manufacturers shed 63,000 jobs, according to the latest data from the Bureau of Labor Statistics. It wasn’t just labor that was hurting. The Institute for Supply Management’s manufacturing index clocked in at 47.9 for December, marking the 10th consecutive month of contraction as new orders were especially weak and costs at historically elevated levels, Bloomberg writes.

Overall, the evidence reveals a sector that’s stagnant at best, and a long way from the manufacturing renaissance President Donald Trump promised when he took office for a second time a year ago. No wonder administration officials have pivoted from predicting a factory boom in 2025 to now saying it will happen in 2026 and beyond.

Trump's broad and indiscriminate tariffs confound domestic manufacturing operations in myriad ways

The most basic problem is that modern American manufacturing depends on international trade. As documented by the National Association of Manufacturers, 91% of manufacturers use imports to make things in America, and these inputs constitute around half of all US goods imported each year. Advanced industries such as semiconductors, aerospace and medical devices are particularly reliant on complex global supply chains and cutting-edge components from around the world.

Producers involved in goods trade (imports and/or exports) are large and growing employers – home to around 80% of all US manufacturing workers.

In short, it’s a sector that’s still very large and increasingly very global – or at least it was.

Trump's broad and indiscriminate tariffs confound domestic manufacturing operations in myriad ways. Most obviously, they increase production costs – even when firms buy American. Tariffs on steel, aluminum and copper drove prices in the US for these critical materials to significant premiums over global benchmarks. Tariffs on parts and equipment raise the same issues.

Buying local often isn’t an option. The National Association of Manufacturers estimates that firms running at full capacity could supply only 84% domestic producers’ input needs, meaning at least 16% must be imported. The numbers are much higher for certain commodities such as aluminum that are primarily sourced from abroad.

Global supply chains took years to develop and a few days to destroy

Tariffs have ensured that domestic producers pay significantly more than their foreign competitors for the same inputs — a dynamic that makes US investments less attractive and American goods harder to sell both here and overseas. Foreign retaliation against US exports, which was more muted than expected in 2025 but is still occurring, amplifies these headwinds.

The second problem stems not from the level of tariff rates, but how they’ve been implemented. Manufacturers might be able to adjust to a permanent, uniform and one-time increase in tariffs, but what they face instead is an ever-changing mishmash of opaque and complicated import taxes enacted by executive fiat. Last year, the US tariff code was amended 50 times, a non-pandemic record and far above the pre-Trump standard. These changes, along with constant tariff threats, caused an unprecedented increase in trade policy uncertainty, which weighed on manufacturers’ hiring, capital expenditures, supply chain and sales plans even when tariffs weren’t actually implemented.

Global supply chains took years to develop. They’ll take even longer to reorganize and will do so at great cost if, that is, they don’t break altogether in the meantime.

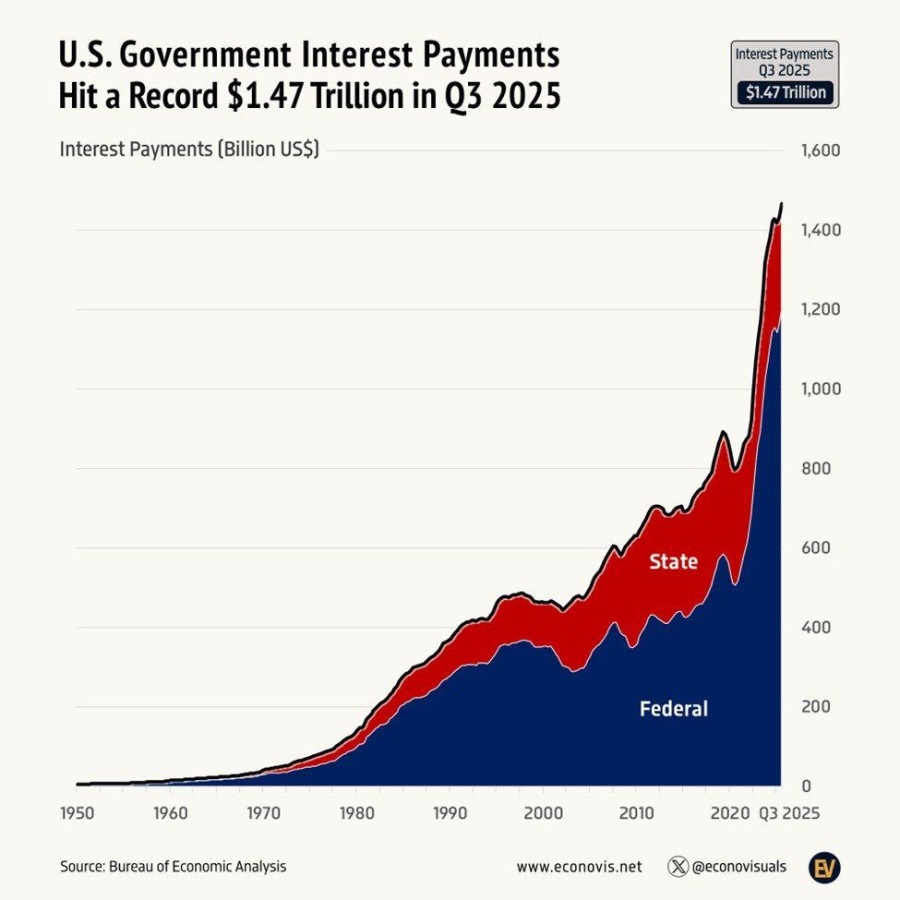

…High tariffs won't save America from its rapidly mounting debt.

Almost one-fifth of the federal budget goes not to supporting American domestic manufacturing operations and workers, but to paying off the debt...

read more in our Telegram-channel https://t.me/The_International_Affairs

11:52 27.01.2026 •

11:52 27.01.2026 •