Colder weather risks elevating already high energy costs. Temperatures through March seen lower than last two years. Europe is set for the coldest winter since 2022 pushing up already elevated energy costs as the continent dips into its gas reserves at a faster-than-usual rate, writes Bloomberg.

Temperatures between now and March are set to remain mostly below levels seen in the last two years, according to data from the European Centre for Medium-Range Weather Forecasts compiled by Bloomberg. That’s likely to push heating demand to the highest level since the start of the war in Ukraine, according to data from Maxar Technologies Inc.

Yet, the continent remains vulnerable to weather disruptions. A cold winter would put more pressure on already elevated gas and power prices. This could coincide with a halt in gas flows through Ukraine from Jan. 1, when temperatures typically fall to their lowest levels.

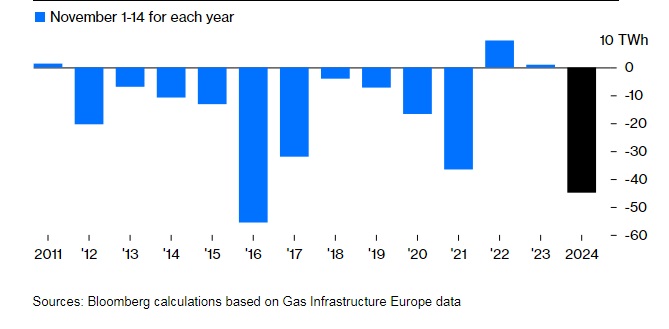

Freezing weather and low-wind conditions have already resulted in faster-than-usual withdrawals from gas storage sites this month. That raises concerns about late winter and next summer’s restocking season.

Temperatures are expected to dip in December, according to Weather Services International, with heating demand rising across Europe to levels exceeding seasonal norms. In Oslo, the mean temperature is forecast to drop as low as -12C on Dec. 8, which is 9C below the 30-year average.

As gas prices rise, politicians are in denial about the challenges a cold winter may pose. European policymakers are gaslighting themselves about the outlook, notes Bloomberg.

The result is another winter of high prices, not just for gas but also for electricity, further darkening the future for energy-intensive companies in the region. Rarely a week goes by without a major manufacturing sector announcing plant closures, job losses and write-downs worth billions of euros. Households, too, will feel the hit; retail gas and electricity prices will climb, boosting inflation and posing another headache for the European Central Bank and the Bank of England.

European wholesale gas prices have risen this week to €47 ($50) per megawatt-hour, double the February low point. While current prices are a fraction of the all-time high set at more than €300 per MWh during the worst of the energy crisis in mid-2022, they remain about 130% above the 2010-2020 average.

The challenge is encapsulated by two prices. First is the cost of gas in Europe, measured by the so-called Title Transfer Facility benchmark. On Wednesday, it was about $14 per million British thermal units. The second is the cost of the same gas, but in the US, measured by the Henry Hub benchmark. On Wednesday, it was at $3 per mBtu. Now, put yourself in the shoes of the board of directors of a global energy-intensive manufacturing company. How long would it take you to decide that Europe isn’t a good location for future investment?

After Russia reduced its gas supply to Europe in 2021, the region responded by implementing energy savings, stockpiling gas during the summer, rolling out more renewables and buying lots of liquefied natural gas from overseas. The measures were all designed to curtail the region’s reliance on the Kremlin and offset the drop in domestic gas production, particularly in the Netherlands where a major gas field was closed for political reasons, and in the UK where the government hiked taxes on North Sea output.

European policymakers presented the combination of policies as a masterstroke of strategic planning. They told themselves they had succeeded. There was, of course, a lot of good policy. But equally there was a lot of luck. And Russian gas continued to flow into Europe, just in a different way.

The luck has run out. The weather has turned cold, calm and dry. The Germans have a word for it: dunkelflaute — a period of windless and cloudy weather that results in little renewable production. Europe suffered a long dunkelflaute in early November, and another is likely next week. And Asia is importing more LNG, pushing up prices. In turn, Europe has been buying about a fifth less LNG than it did during the last two years. The result? Europe is dipping heavily into its gas storage. During the first two weeks of November, gas withdrawals from inventories were the second largest for that period in data since 2010. On current trends, storage levels in November will see their largest drop since 2016 for that month, double the fall seen in both 2022 and 2023.

Last winter, the season ended with storage at 60% full; the previous year, the figure was 55%. It’s very early days, but on current trends, a typical winter would leave inventories in spring 2025 at just under 50%. A cold winter would reduce them to as little as 35%-45%. Whatever the outcome, one thing is clear: Europe will have to buy a lot of gas next spring and summer to rebuild its buffer ahead of the 2025-2026 winter.

That’s the reason why European gas prices from April 2025 to October 2025, typically the shoulder demand season which sees cheaper gas, are trading at unusually elevated levels compared to the November 2025 to March 2026 period. For consumers, the trend in the wholesale market means higher-for-longer retail prices.

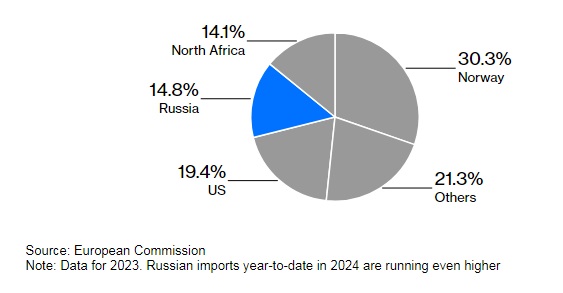

And then, the gaslighting. Europe has deluded itself into thinking that it had largely solved its Russian gas reliance problem. It never did. It’s true it cut its reliance on Russian pipeline gas, although not completely. But it also increased its purchases of Russian LNG. After Norway and the US, Russia remains the third-largest source of European gas imports, according to official data.

European Commission President Ursula von der Leyen has floated the idea of replacing Russian LNG with American LNG to please incoming President Donald Trump. More delusion. The idea makes no sense. First, US production is already largely committed. If Europe wants more US LNG, it will have to pay higher prices than Asia to divert cargoes. European utilities, under pressure to meet green targets imposed by Brussels and national governments, are very unlikely to commit to the kind of contracts lasting 15 to 20 years that American LNG producers demand. The comments sounded like a desperate attempt to pretend a policy is in place.

read more in our Telegram-channel https://t.me/The_International_Affairs

11:28 28.11.2024 •

11:28 28.11.2024 •