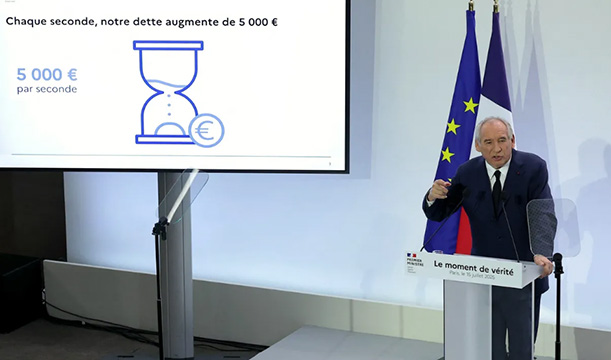

France's Prime Minister Francois Bayrou in Paris, on July 15.

France's Prime Minister Francois Bayrou in Paris, on July 15.

Photo: AFP

The French deficit story "is a ticking bomb for EU sentiment", according to currency strategist Franceso Pesole, who says "we could start seeing some FX spillovers in the coming months", Bloomberg quotes.

French bonds "have been trading with an embedded risk premium for a long while" and "so much bad news is already in the OATs' price", according to macro strategist Ven Ram.

Angst around how France will control its swelling budget deficit is returning to financial markets and may start to dent demand for the euro, according to strategists at ING Groep NV.

The common currency touched its weakest level against the dollar in a month on Tuesday as France’s minority government revived political tensions with proposals to sharply rein in the deficit, including scrapping two national holidays.

While the currency move was largely dollar led, with US inflation data driving the greenback higher, it also sent a warning for investors about the political and fiscal challenges in the euro area’s second largest economy, currency strategist Franceso Pesole said.

“The French deficit story has been very much in the background as of late, but yesterday probably served as a reminder that it is a ticking bomb for EU sentiment,” he wrote in a note on Wednesday. “We could start seeing some FX spillovers in the coming months.”

Prime Minister Francois Bayrou’s €43.8 billion ($50.9 billion) plan to narrow the deficit risks another government collapse. With no majority in parliament and opposition parties opposed to the spending cuts and tax increases, he could be forced to resign in a no-confidence vote in the fall — the same fate that met his predecessor, Michel Barnier, in December.

The euro traded around 0.2% higher at $1.16 on Wednesday. Pesole sees a risk the currency will drop to $1.15 in the coming days, if US economic data releases further dent confidence around imminent Federal Reserve interest-rate cuts.

What Bloomberg strategists say:

“French bonds have been trading with an embedded risk premium for a long while and the nation’s 10-year securities offer a higher yield than lower-rated economies in Spain and Portugal. So much bad news is already in the OATs’ price and further significant losses don’t seem warranted just yet.”

read more in our Telegram-channel https://t.me/The_International_Affairs

10:20 19.07.2025 •

10:20 19.07.2025 •