Russia and China appear to be moving forward with a major natural gas pipeline between their countries after years of stalled negotiations. Russian energy giant Gazprom PJSC said it has signed a legally binding memorandum with China National Petroleum Corp. to build the Power of Siberia 2 pipeline.

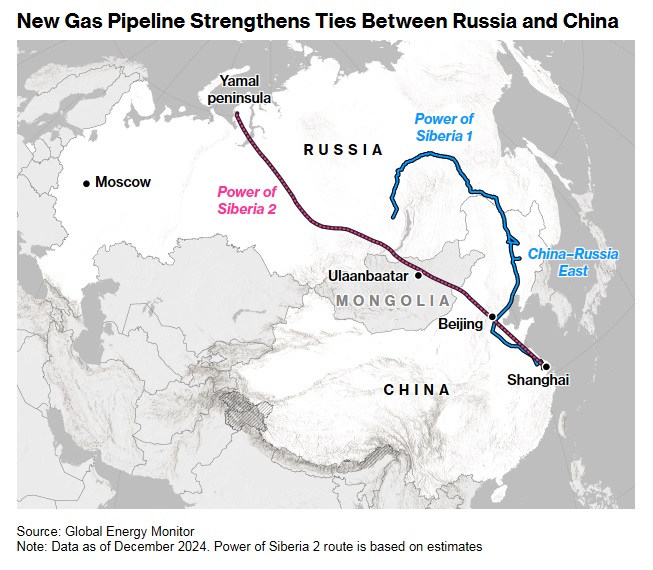

When the conduit from Russia’s Arctic Yamal Peninsula to northeast China goes ahead, it would deepen the economic ties between the two neighbors, who have already been growing closer in recent years as Russia grapples with Western sanctions, Bloomberg stresses.

The pipeline could also potentially reshape global gas flows next decade. For Russia, Power of Siberia 2 is an opportunity to compensate for some of the lost sales of piped gas to Europe, after the region turned to other sources following the full-scale invasion of Ukraine. For China, the pipeline offers a hedge against supply risks in the liquefied natural gas market, where its geopolitical rival the US has become the world’s biggest exporter of the superchilled, seaborne fuel.

How big will Power of Siberia 2 be?

Gazprom Chief Executive Officer Alexey Miller has described the planned Power of Siberia 2 pipeline network across Russia, China and Mongolia as “the largest, the most massive and capital-intensive gas project in the world.”

There’s more than 4,000 kilometers between the pipeline’s origin point in the Arctic Circle and its potential end point at China’s coastal megacities. It will span 2,600km within Russia alone, stretching across the Siberian forests, before traversing nearly 1,000km through Mongolia and the country’s grasslands.

At full capacity, Power of Siberia 2 will be able to transport 50 billion cubic meters of gas per year, almost as much as the now-dormant Nord Stream 1 pipeline that runs through the Baltic Sea from Russia to Germany.

How does that compare to Russia’s existing pipeline exports to China?

Russia already sends pipeline gas to China via Power of Siberia 1 under a 30-year supply agreement. Flows via this route, which bypasses Mongolia and connects the two countries directly, commenced in 2019 and reached the pipeline’s capacity of 38 bcm this year. A second conduit, the Far Eastern route, is expected to start operating in 2027.

Gazprom, which is majority-owned by the Russian government, said it has also agreed with CNPC to increase deliveries via these two gas corridors to a combined 56 bcm, up from their previous deals totaling 48 bcm, Russian state newswire TASS reported. The addition of Power of Siberia 2 could therefore allow Russia to roughly double its pipeline exports to China.

The cost of Power of Siberia 2, how it will be financed and how long it will take to build are some of the key details that have yet to be disclosed.

The Carnegie Russia Eurasia Center calculated that the construction cost could be $36 billion for the sections through Russia and Mongolia. A significant part of the route across Russia will run through the Siberian territories where Gazprom already operates pipelines, enabling savings on build time and costs.

Power of Siberia 2 will cross a variety of terrain and operate in vastly different temperatures throughout its length. Building pipelines across harsh environments isn’t easy, but Russia and China managed to stick to schedule for Power of Siberia 1, which extends for more than 6,000km across the two countries and started its first gas flows just five years after the agreement to build the project was signed.

How much gas will China import via Power of Siberia 2?

Gazprom’s CEO said the supply deal for Power of Siberia 2 is also for 30 years, Tass reported. However, it’s unclear whether China will commit to a fixed-volume contract that makes use of the pipeline’s full capacity, or if it will push for a more flexible arrangement in case domestic gas demand falters or cheaper sources of gas arise.

Russia will want China to agree to buy all the gas whether it needs it or not, to ensure steady future payments.

How much will China pay for the gas?

The price of the gas Russia will supply via Power of Siberia 2 has been a key sticking point in negotiations for years.

Russian President Vladimir Putin said in early September that the price will be “market-based” and calculated using a formula with different components to those used for European contracts.

Gazprom’s CEO has said that the gas supplied via the new pipeline will be cheaper than what buyers pay for Russian gas in Europe. Deliveries via Power of Siberia 1 are among the cheapest gas imports into China, according to BloombergNEF. It estimates that for the upcoming winter, Russian pipeline gas is around a third cheaper than China’s contracted volumes of LNG and less than half the cost of spot LNG imports.

Why is the pipeline important to Russia?

Sending more flows eastwards could help Gazprom offset Europe’s pivot away from Russian pipeline gas after the full-scale invasion of Ukraine in 2022. Europe’s imports of gas have fallen from around 150 bcm in 2021 to less than 10% of that level so far this year. While the region is still buying Russian LNG, the European Union is considering plans to end purchases of all types of Russian gas by the end of 2027.

Power of Siberia 2 could materially increase the flow of Russian gas to China. And unlike Power of Siberia 1, which transports gas from Eastern Siberia, the new pipeline will send fuel to China from the Yamal gas fields in Western Siberia that used to supply Europe. At full capacity, Power of Siberia 2 would be equivalent to a third of Russia’s pre-war gas exports to Europe.

Construction of the new pipeline could also have ancillary benefits for the Russian economy, which has become more isolated after the invasion of Ukraine, by boosting demand for Russian workers and steel.

What does the new pipeline mean for the rest of the gas market?

China is the world’s largest importer of LNG and the gas flows via Power of Siberia 2 could reduce its demand for seaborne shipments. It’s unclear when the pipeline will start up, but given the timeline of Power of Siberia 1, it’s likely to be on the other side of 2030.

Supply from the new pipeline and the expansion of the other two conduits from Russia could replace China’s need for more than 40 million metric tons of LNG per year, according to BloombergNEF. That’s equivalent to more than half the country’s imports of the supercooled fuel last year.

If China buys less LNG, this could free up supply for importers elsewhere in Asia and in Europe, bringing down prices and helping ease inflationary pressures. That’s good news for LNG buyers but less so for exporters, in particular new terminals coming online and developers looking to make a final investment decision on prospective projects. Less appetite from China for LNG could undermine President Donald Trump’s push to boost US energy exports.

A growing oversupply was already expected in the global LNG market in the next few years as new export facilities start up. If Power of Siberia 2 becomes operational by the early 2030s, it could extend the supply glut and weigh on prices.

read more in our Telegram-channel https://t.me/The_International_Affairs

11:22 11.09.2025 •

11:22 11.09.2025 •