You wouldn’t know it by the headlines. But the US economy is breaking in plain sight. Only the savings cushion of the richest 20% are keeping it afloat. And if interest rates keep rising nearly every day, even that won’t be enough, writes Bloomberg.

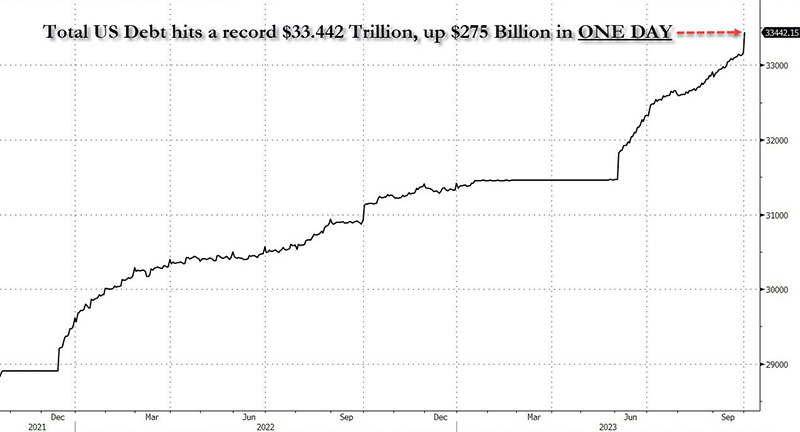

The tone has changed, too. Last quarter, the drive higher in real and nominal yields seemed driven by soft-landing bets. Now the dynamic seems less based on such an optimistic outcome, with former bond bulls switching sides and chasing yields higher amid a glut of Treasury supply. That’s having broad implications by pulling up the US dollar and elevating rates across the world financial system, from mortgages to high-yield bonds and beyond.

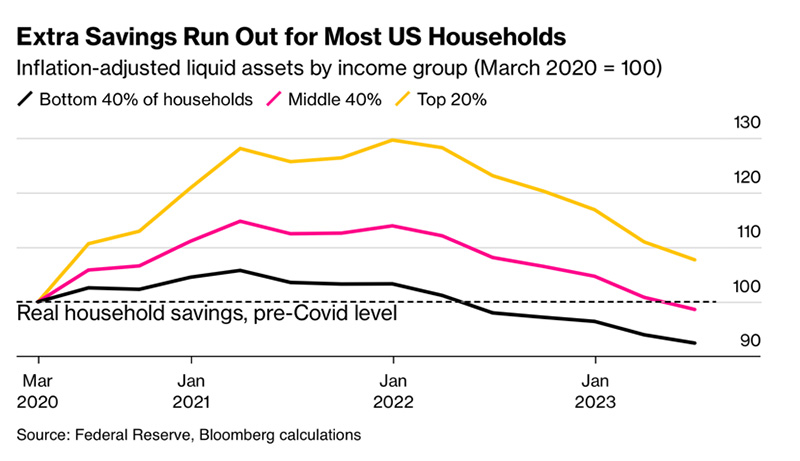

We’re running out of extra savings. Through the pandemic and into this year, the shot in the arm from government transfers has been a huge cushion for the private sector. But the San Francisco Fed has recently calculated that excess savings from the pandemic will be all gone by September.

And in fact, Bloomberg Economics calculates that the least wealthy 80% of workers now collectively have less cash on hand than they did when the pandemic started.

As inflation, rising rent costs and higher interest rates hit early in 2022, the money had already run out for the bottom 40% of households. But this year the same has happened for the middle 40%, with extra pandemic savings for the top 20% on a downward trajectory close behind. Since the higher-income households tend to save more anyway, it seems like the support for consumer spending has already more or less disappeared.

If personal savings rates increase enough as the top 20% of households deplete their pandemic savings, that will drive the US economy into a recession.

The economy is not only about the spending habits of households but the investment decisions of businesses and the availability of credit. The Silicon Valley Bank (SVB) collapse was a blow on that front but not a fatal one, as credit only mildly tightened.

The losses by regional banks due to interest rates increasing will restrict credit further. After a couple of quarters of those losses diminishing, they are now increasing again. And they will increase even more as long-term interest rates rise.

As long as yields remain high, they are keeping balance sheets under stress.

We cannot expect linear outcomes with yields, the dollar and oil prices all rising in tandem. Eventually there will be a torrent of equity selling and a much greater risk of recession as spending slows and precautionary savings grows.

But the move higher in yields has become so extended that we expect a reprieve soon, especially if the economic data start to slow. That will allow for more glide-path outcomes, including even a soft landing. The base case is still a recession, starting as soon as December.

A soft landing remains possible. Is it the most likely outcome, though? With the US confronting the combined impact of Fed hikes, auto strikes, student loan repayments, higher oil prices, and global slowdown we think not.

read more in our Telegram-channel https://t.me/The_International_Affairs

11:21 05.10.2023 •

11:21 05.10.2023 •