Whether the EU would return to importing Russian pipeline gas remains to be seen. It’s unlikely the bloc would want to relinquish control of its energy security back to Moscow, notes Bloomberg.

Europe’s stockpiles of natural gas have been a closely watched metric.

The network of gas storage sites across the European Union is the second largest in the world after the US and has become an increasingly important buffer against supply shocks and price spikes.

The EU had managed to avoid a winter supply crunch by curtailing overall gas demand and boosting its imports of liquefied natural gas from the US, Qatar and even Russia.

But 2025 could up the pressure. Adverse weather conditions have seen Europe burn through its gas reserves more quickly over the winter and seasonal price spreads flipped to make it uneconomic to refill inventories over the summer.

Europe leans on its gas inventories in the winter, when average consumption doubles as the heating is turned up. While the continent’s gas suppliers — from Norway and Algeria to Qatar and the US — typically boost their production to maximum levels, it’s not enough to meet the increased demand.

As a result, the gas held in storage covers about 30% of the EU’s daily needs during the winter. This proportion can top 50% on the chilliest days, especially if wind speeds are low and electricity output from renewable sources slumps.

The exact volume depends on gas prices and on demand elsewhere, such as in Asia and Latin America. Europe’s exposure to the dynamics of the global gas market has increased dramatically since Russia’s massive supply cuts to the region in 2022.

the EU appears determined not to revert to the same level of reliance on Russia. Under the bloc’s REPowerEU plan, it aims to phase out its dependence on Russian fossil fuels by 2027.

The EU’s gas stockpiles quickly depleted over the winter 2024-25 heating season. Colder weather than a year earlier and more windless days increased demand for gas and forced countries to tap their storage. Combined with the loss of Russian pipeline gas via Ukraine, the bloc’s depots were only around 50% full in early February, well below the nearly 70% seen a year prior and the lowest level for this time of year since the 2022 energy crisis.

There’s no immediate threat of Europe running out of gas, but there are concerns about the pace of storage refills needed to be ready for the next winter. Officials across the bloc have been grappling with how to meet their inventory targets. Italy has pushed for an early start of stockpiling, while Germany has discussed subsidies for storage refills.

Fears over how Europe will replenish its storage stoked a surge in the price of summer gas contracts and drove near-term prices to a two-year high on Feb. 10. In turn, energy bills have remained elevated, prolonging pain for Europe’s households and businesses, just as recession risks are back in focus for the likes of Germany and the UK.

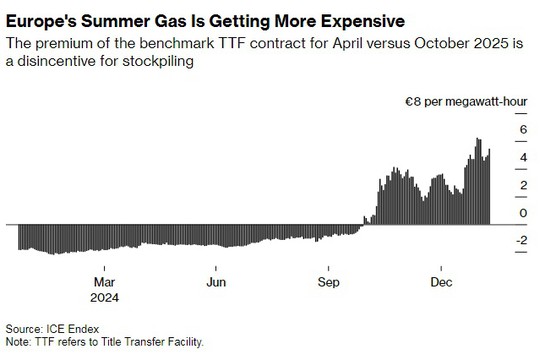

The spread between summer and winter gas contracts is key to determining whether there’s an economic incentive to stockpile gas for the next winter. Buyers typically look to take advantage of cheaper summer prices, store the gas and then either use it in the winter or sell it for a profit.

But purchasing gas for summer 2025 has become more expensive than for the next winter. The spread reached its widest in three years in January. It was still elevated at around €5 per megawatt-hour ($5.16 per megawatt-hour) on Feb. 10.

That equates to a roughly €3 billion deficit between buying in summer and selling in winter for all the gas Europe may need to add to its storage to hit its 90% target, according to Bloomberg Intelligence. Those are potential losses for energy companies, traders and even some consumers who stockpile gas.

…EU stands firm on its position – “Europe will become free from gas from Russia!”

So, no gas from Russia, although gas reserves are dwindling and gas prices are rising.

Well, good luck!

read more in our Telegram-channel https://t.me/The_International_Affairs

11:17 17.02.2025 •

11:17 17.02.2025 •