Russian Rosatom Corp. continues to be the dominant source of fuel for the world’s nuclear power stations — supplying about half of global demand for enriched uranium. Western nations are racing to reconstitute their own processing capacity, much of which withered amid a growing aversion to nuclear power following Japan’s Fukushima meltdowns. But progress is likely to be slow, notes Bloomberg.

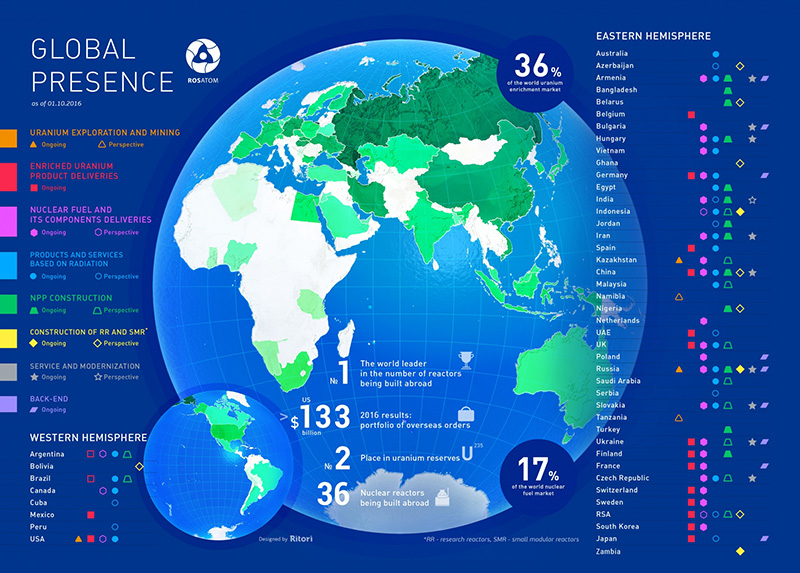

Unlike Western companies in the nuclear business, Rosatom is involved in every part of the supply chain, from ore extraction to fuel enrichment and delivery. The company is as much an expression of the Kremlin’s geopolitical power as a profit-generating business. That state-level commitment has played to Russia’s advantage.

When international investors turned away from nuclear power following the Fukushima accident in 2011, some Western companies involved in the fuel cycle, including Areva SA in France, the US Enrichment Co. and Westinghouse Electric Co., went bankrupt. Russia stepped in, building market share not only among the world’s existing fleet of nuclear reactors, but by offering generous financing for new foreign projects. Today, Rosatom’s 330,000 workers provide fuel assemblies to scores of old reactors in eastern Europe and Russia, and is building 33 new power units in 10 countries, including China and India, that will be locked into fuel contracts for decades ahead.

Former Soviet satellites in eastern Europe continue operating dozens of so-called VVER pressurized water reactors built during the Cold War era. Most of those aging units use Rosatom fuel and are already running on borrowed time, generating electricity beyond the initial period that regulators licensed them to operate. That means there’s little incentive for new companies to enter that market and compete against Russian supply.

There are some exceptions. Westinghouse, after emerging from insolvency in 2018, signed contracts to fuel some of Ukraine’s VVER reactors. But even there, Ukraine continues to rely on Rosatom inventory and won’t be able to fully diversify away from Russia until later this decade. It’s a similar challenge from Bulgaria to the Czech Republic and Finland, where the search for alternative suppliers is expected to take years. In all, Russia covers about 30% of the European Union’s demand for enriched uranium.

Atomic trade between the countries grew in the aftermath of the Cold War under the so-called Megatons to Megawatts program, which converted 500 tons of Russian weapons-grade uranium into fuel suitable for US reactors. Russia continues to be a major provider of uranium mining, milling, conversion and enrichment services for US utilities, exposing US consumers to potential disruption. In 2022 it supplied about a quarter of the enriched uranium purchased by US nuclear power reactors, according to US government figures. Most vulnerable is the provision of uranium enriched to higher levels, which is used by a new generation of so-called small modular reactors (SMRs) because it reduces the frequency of re-fueling. Rosatom currently supplies all the so-called HALEU, or high-assay-low-enriched uranium, to the US.

What is being done to reduce reliance on Russia? Perceived economic vulnerability on both sides of the Atlantic is prompting unprecedented cooperation in rebooting the nuclear fuel cycle. The US and Canada in March pledged to jointly rebuild North American capacity. The US, UK, Canada, Japan and France followed up with a separate agreement to develop “shared supply chains that isolate Russia.” Industry executives figure it will take about five years to complete the pivot away from Moscow.

Nevertheless, Rosatom said it was “aware of the risks” and “will protect its interests” in part by offering countries “the best solutions that have already been tested,” Bloomberg informs.

read more in our Telegram-channel https://t.me/The_International_Affairs

11:17 01.09.2023 •

11:17 01.09.2023 •