The picture above shows the Bonfire of the Vanities (Falò delle Vanità)in 1497 in Florence. Objects of sin like art, books, cosmetics etc were burnt. Tom Wolfe wrote an excellent book with the same title in 1987.

The picture above shows the Bonfire of the Vanities (Falò delle Vanità)in 1497 in Florence. Objects of sin like art, books, cosmetics etc were burnt. Tom Wolfe wrote an excellent book with the same title in 1987.

Egon von Greyerz, a Swiss financial analyst, Founder and Managing Partner “Matterhorn Asset Management”, writes:

Some time ago, I wrote an article with the title: THE MOST IMPORTANT ARTICLE I HAVE PENNED.

It is a story about three investors, two real and one fictional (The Wise, the Unlucky and the Greedy). Their destinies are very different…

The article starts with Brutus’ speech in Julius Caesar about choosing the right current: “…AND WE MUST TAKE THE CURRENT WHEN IT SERVES, OR LOSE OUR VENTURES.”

So, what do I mean by that?

Simply, we are now at the point when investors must take The Current or lose it all.

Let me just repeat what I have said many times:

Forecasting time and price is a mug’s game. But we all do it sometimes.

This is a lesson I have learnt after about 65 years of market experience.

Instead of time and price, it is much more important to understand TRENDS and RISKS.

This is what led me (in 2002 at $300) to purchase larger amounts of physical gold for ourselves and the investors we advised, based on our wealth preservation principles.

Gold had then corrected for over 20 years, and a credit explosion was in the making.

At the time, I told major clients to put more than 50% of their liquid assets in physical gold. They haven’t regretted it.

And today, for the first time in the last 25 years, main stream media and investors are starting to talk about gold.

So, it has taken a quarter of a century and a 10-fold increase in the gold price for the public to wake up!

For some time, $3,000 has been an obvious magnet for gold, as I have written about many times. But $3,000 is certainly not a target – it is not even a price where gold will consolidate.

It is just a round figure where gold will not stop for long. As I wrote in a recent article: NEXT GOLD MOVE WILL SURPRISE THE WORLD.

Many investors have not bought gold recently as they have been waiting for a correction. But we have told investors that gold is very unlikely to pause at this level. Instead, once properly past $3,000, we are likely to see an acceleration.

Where I was wrong on the trend was in stock markets. I definitely thought that 2008 would be the start of a secular bear market, but massive money printing created miracles and fuelled markets for another 17 years.

We were out of stocks since the beginning of this century which has been beneficial since gold has outperformed stocks even with dividends reinvested.

So, instead of a market collapse in 2008, massive money printing and credit expansion have created the biggest stock market bubble in history.

So, if we look at the Dow Gold Ratio (the Dow divided by Gold), back in the year 2000, the ratio was 45. It is now 14. The ratio has just broken a 12-month trend line and is now about to accelerate down.

This means the Dow has fallen 69% against gold in the last 25 years.

More importantly, if the ratio reaches long-term support at 0.5, it would mean a 97% fall from here. But I doubt it will stop there.

That could mean Gold $20,000 and Dow 10,000.

Since the 1990s, I have privately talked about the inevitability of a collapse of the current monetary system, just like every monetary system in history has collapsed, without exception. The simple reason is, of course, the exponential growth of credit.

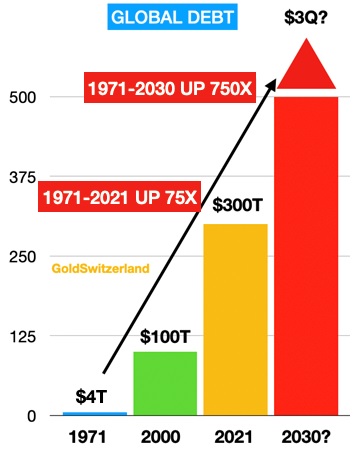

As the graph shows, Global Debt grew 75 X from 1971 to 2021. Today, it is around $360T. But if we add unfunded liabilities and derivatives which is a form of debt (when the derivative market implodes), then total debt and liabilities are around $3 quadrillion.

So we are likely to see a debt collapse with bonds crashing (rates up), banks “borrowing” or blocking client funds or governments forcing bank accounts to buy 100-year bonds at ZERO interest. And obviously, the dollar will fall precipitously.

At best, we will see a restructuring and, at worst, a collapse of the banking system.

If any of the above risks happen, investors in cash or securities will experience the biggest wealth destruction in history.

Governments can NEVER pay the capital or interest with regular money. Only with massively depreciated fiat money.

We will likely see Capital Controls in many countries, including the US and EU.

The main restriction will be that you can’t transfer funds out to, for example, buy a property or live abroad.

Finally, remember that family and friends are what life is about.

So, helping others, especially in the difficult times ahead, is critical.

read more in our Telegram-channel https://t.me/The_International_Affairs

9:48 26.04.2025 •

9:48 26.04.2025 •