It’s been a topsy-turvy last year for the euro zone with its largest economies, Germany and France, seeing political and economic turbulence that means neither has a budget in place for 2025, CNBC stresses.

Economists say the trajectory for both countries is worrying, warning that the absence of growth, fiscal imbalances and political intransigence could lead to decline and a loss of standing for Europe, as a whole.

“The situation today is different from the earlier [sovereign debt] crisis insofar as Europe’s most acute problems are no longer concentrated in smaller economies like Greece. Instead, it is Europe’s two most important economies that are struggling,” Neil Shearing, group chief economist at Capital Economics said in analysis in December.

“Europe faces ongoing decline without fundamental reform at its core,” Shearing said, noting that if this is not carried out, “it is difficult to escape the conclusion that Europe’s future is one of very low growth, continuing concerns about fiscal sustainability and a dwindling sense of standing in a world increasingly characterised by a superpower rivalry between the U.S. and China.”

As it stands, neither France nor Germany has a 2025 budget in place amid political infighting that ultimately brought down their governments.

New elections are set to take place in Germany in February, and analysts are placing bets on new parliamentary elections in France next summer. The countries are now operating with provisional budgets, after rolling over their 2024 taxation and spending provisions into this year, and it’s uncertain when either will agree a 2025 budget.

France and Germany contend with different economic challenges, reflecting both the dangers of overspending and of underspending.

France had a budget deficit estimated to hit 6.1% and a debt pile seen at 112% in 2024, according to the IMF. The new government under Prime Minister Francois Bayrou is expected to struggle to get warring deputies on all sides to pass a 2025 budget, just as did his predecessor Michel Barnier.

Germany, meanwhile, faces a snap federal election in February, after the governing coalition under Chancellor Olaf Scholz collapsed in the fall due to divisions over economic and budget policies.

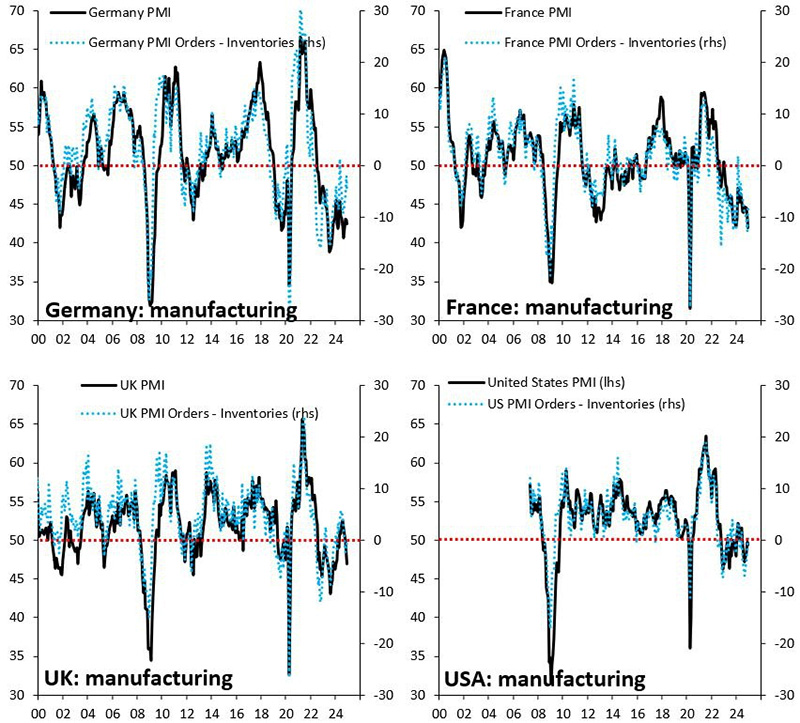

Economists say that the lack of budgetary plans means that Europe’s major economies will not be able to fully focus on policies aimed at economic expansion, continuing a worrying trend in recent years of anaemic growth.

This has been caused by a confluence of events, such as the war in Ukraine and the rise in energy prices, a factor that has hit energy-intensive industries in Europe, but has also been exacerbated by weaker demand — both in terms of external demand from the likes of China, and weaker consumer demand within Europe — as well as deeper structural problems, such as low productivity growth and a lack of competitiveness.

“Our base case is that Europe will face a pretty difficult year in 2025,” Jari Stehn, chief Europe economist at Goldman Sachs told CNBC, with the investment bank forecasting 0.8% growth for the euro zone in 2025 — compared with 2.5% for the U.S., over the same period.

“There are lots of issues... high energy prices, China slowing, political uncertainty, trade tensions are all negative things,” he told CNBC’s “Squawk Box Europe.” Investors were still looking for potential bright spots in the region, however. People are also asking whether the European consumer could finally surprise to the upside, the saving rate is high, there’s actually quite a bit of money [that could be spent], but again we think there will be some support but it’s unlikely there will be a big upside surprise. Ultimately, it’s going to be a challenging environment.”

read more in our Telegram-channel https://t.me/The_International_Affairs

10:02 06.01.2025 •

10:02 06.01.2025 •