Germany's Deutsche Bank said "The AI bubble is the only thing keeping the US economy together." Investors recoiled in disbelief upon hearing this, but when looking at the Earnings Per Share of the S&P 500, Deutsche Bank seems to be accurate.

The Standard and Poor's 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 leading companies listed on stock exchanges in the United States.

Yet one-third of the value of the S&P 500 consists of the "Magnificent 7."

The "Magnificent 7" (i.e. "Mag 7") refers to seven large-cap technology companies: Apple, Microsoft, Alphabet (Google), Amazon, Meta (Facebook), Nvidia, and Tesla — that have driven significant market gains and have a substantial impact on the S&P 500.

These companies are dominant players in various sectors, including the internet, artificial intelligence (AI), and electric vehicles, and were named to evoke the 1960 Western film of the same name due to their role in driving market growth.

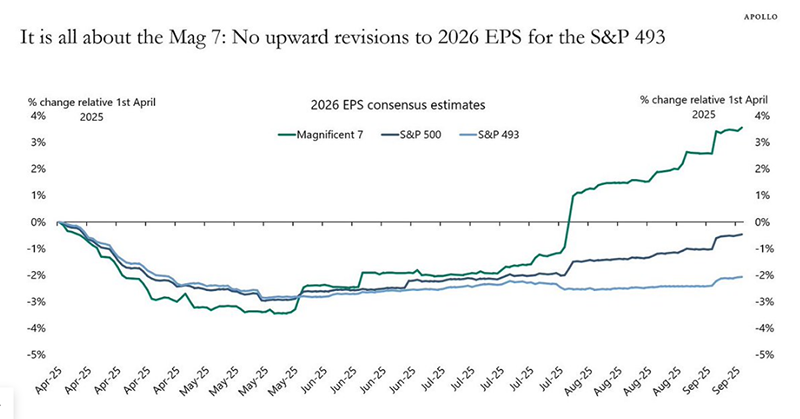

When you compare Earnings-Per-Share of the Mag 7 to the other 493 companies comprising the S&P 500, you see the reality:

There are NO UPWARD REVISIONS for the S&P 493!!!!!!!

Pretty much the entire S&P 500 "rally" has been in the Mag 7 stocks. The S&P 493 -- are all down in Earnings per share.

Folks, that's 493 of America's top 500 companies, are all showing LOWER expectations.

THAT is the U.S. economic reality.

The AI bubble isn’t just hype. It’s the glue. The mask. The lifeline.

Deutsche Bank has stated that the AI bubble is currently the primary factor keeping the US economy from slipping into a recession. This is because AI-related spending, especially on building AI data centers and infrastructure, is driving more economic growth than all consumer spending combined.

But the market? Still floating.

Why? Because everyone believes AI will save it.

This isn’t innovation anymore. It’s inhalation. They’re breathing AI fumes and calling it GDP.

One pop — and the illusion goes with it.

read more in our Telegram-channel https://t.me/The_International_Affairs

15:23 12.10.2025 •

15:23 12.10.2025 •