Christine Lagarde, president of the European Central Bank, with colleges

Pic.: POLITICO

The United States and the euro zone should not take the international status of their currencies for granted as countries such as China and Russia seek to create their own systems, said Christine Lagarde, president of the European Central Bank.

The dollar's 80-year-old reign as the world's reserve currency is being called into question by some commentators in light of China's rise as a global power, burgeoning debt at home and geopolitical challenges to Western influence from Ukraine to Taiwan. Lagarde said "a new global map" was being drawn, with some countries seeking alternative invoicing currencies such as the as the Chinese renminbi or the Indian rupee, accumulating gold or setting up their own payment systems.

"These developments do not point to any imminent loss of dominance for the U.S. dollar or the euro," Lagarde said in a speech. "So far, the data do not show substantial changes in the use of international currencies."

"But they do suggest that international currency status should no longer be taken for granted," she said at the Council on Foreign Relations in New York.

Around 60% of the world's foreign exchange reserves and international debt is denominated in dollars, with the euro a distant second at 20%, according to data compiled by the ECB.

U.S. authorities have so far dismissed the notion that the greenback's global primacy, born with the Bretton Woods agreement of 1944, was about to end and even suggested it could be bolstered by the launch of a digital dollar.

Pic.: POLITICO

Pic.: POLITICO

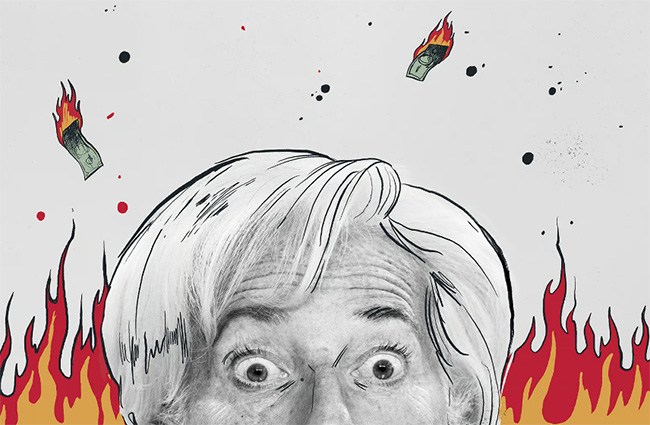

The ECB president has sounded the death knell for the dollar and predicted the end of the world economy as we know it — does she know something we don’t? – asks POLITICO.

Deep in the Wyoming wilderness last month, Christine Lagarde, president of the European Central Bank, stood before a large audience of elite central bankers and casually predicted the collapse of the international financial order.

“There are plausible scenarios where we could see a fundamental change in the nature of global economic interactions,” Lagarde announced drily to the crowd, which was gathered for the annual central banker confab in Jackson Hole, Wyoming. The assumptions that have long informed the technocratic management of the global order were breaking down. The world, she said, could soon enter a “new age” in which “past regularities may no longer be a good guide for how the economy works.”

“For policymakers with a stability mandate,” she added with understatement, “this poses a significant challenge.”

A “new age”? — and coming from a member of that most dreary and unimaginative of the global technocratic-priesthoods, the central bankers? The warning at Jackson Hole wasn’t even the first time Lagarde has fretted publicly about the fate of the international order of free markets, dollar dominance and globalization that she had a hand in creating. While others have raised the issue, Lagarde has been outspoken. Just in April, she was the first major Western central banker to raise explicit concerns about the fragility of the greenback, whose international dominance she said “should no longer be taken for granted.”

It was, all told, decidedly odd from the leader of the hallowed monetary authority, whose communications department rarely holds forth on anything more gripping than balance sheet policy and deposit rate adjustments. Coming from a woman whose long career in the upper echelons has been defined by a deference to the U.S.-led international order, it was apostasy, even. Most alarming was Lagarde’s seeming indifference to the power of her own words over the state of said international order.

But it’s hard not to wonder whether Lagarde, after a lifetime managing the global establishment from crisis to crisis, has identified a potential extinction event — and is making her pitch that, once more, it is she who ought to help the world avert it. “I agree she’s on to something,” said the retired fixed-income investor Jay Newman. “There will be big shifts in trade and investment.”

“What Lagarde said is not the natural thing for a central banker to say, in the sense that they typically don’t go for the tail-risk as a baseline,” panicked one analyst in nervous anonymity, referring to a kind of risk that is rare but deadly. “Maybe she doesn’t realize what an unusual communication it is for a central banker — or maybe she knows something we don’t.”

So what does Lagarde want? The problem is it’s tricky to get a grip on what, if anything, actually moves her.

What does she do for fun? She rarely reads for pleasure. Nobody interviewed by POLITICO has ever seen her read a book, or anything that isn’t a policy briefing. In terms of world-view, those who know her deduce that if she believes in anything she’s a centrist, or vaguely center-right. But most stop short at “pragmatic.”

Unlike many of the technocrats she finds herself surrounded by, however, she is a charming chancer and a skilled communicator. She possesses an uncanny, predisposition for finding the driving beat of history — and if not exactly seizing it, surviving it.

It is also highly likely that she earnestly believes things are taking a turn for the worse, and is, in a way, mourning the collapse of the globalized system that she shaped and that in turn shaped her. And in grappling with a world off balance, it helps to have a lawyer deliver the bad news. Effective monetary policy requires the synthesis of planetary volumes of data, and, as her colleagues say, Lagarde has the training to inhale great galaxies of the stuff, spending much of her waking life wading through dense briefing material. “Read the footnotes in her speech,” the veteran market-watcher Podolsky urged. “All she is doing is, lawyerly-like, reading — or having her staff read — all the staff research coming from the ECB, OECD, and IMF, and pulling out the pieces that support her questioning.”

As Lagarde has learned, predictions from a major central banker carry the risk of being self-fulfilling. “If she was finance minister nobody would pay attention,” noted the analyst speaking on condition of anonymity. With inflation raging, as Lagarde herself noted in a recent speech, the public is ever more attuned to the bank’s operations and communications, which makes the economy, in turn, more sensitive to Lagarde’s touch. This, she added, provides “a valuable window of time to deliver our key messages.”

And if armageddon never arrives? She’ll be well placed to take credit for averting it. Lagarde — as with most central bankers — was humiliated by the sudden rise in inflation. As Brad Setser, a former staff economist at the U.S. Treasury, said, her recent comments reflect a desire to emphasize the risks as a form of damage control. “It comes from a need to be reserved,” he said.

Call it ‘apocalyptic expectations management.’ If ECB policy fails to steer Europe safely through global economic fragmentation, Lagarde can quite comfortably say that, ‘Well, sorry, but she always warned it might.’

read more in our Telegram-channel https://t.me/The_International_Affairs

10:49 04.10.2023 •

10:49 04.10.2023 •