Residents of "blessed" England are ready to flee far, far away, because they cannot live normally on the island under the growing financial pressure from the authorities and the general crisis – both economic and social, associated with the waves of migrants that have flooded the country. FT writes about.

Wolf, a 30-year-old software engineer, recently became a father for the first time and is already contemplating moving his family out of the UK. “We now have to choose between London and a second child,” he says, blaming the triple whammy of high rents, high childcare costs and high taxes.

European capitals such as Madrid, Paris or Berlin are not quite so costly, and tech sector salaries there are on a par with London. He says plenty of non-property owning friends in the capital are thinking the same, or have already gone.

“To rent a decent two-bed flat in London, you’re looking at £3,000 per month, plus another £2,000 per kid in childcare costs, assuming you don’t qualify for the subsidy — and all this from your post-tax income,” Wolf says, noting the eye-watering tax rates for those earning six-figure salaries.

“It feels like the UK government just wants this problem to go away. Well, they might just get their wish.”

FT Money has received dozens of emails from readers seriously thinking about leaving the UK in search of lower taxes and better opportunities. Our recent callout attracted plenty of responses from younger professionals, as well as entrepreneurs seeking to minimise capital gains tax bills on the sale of a business by relocating overseas. Plus, recent changes to the UK’s long-term residence rules create an opportunity for British nationals leaving the country to avoid inheritance tax on their non-UK assets.

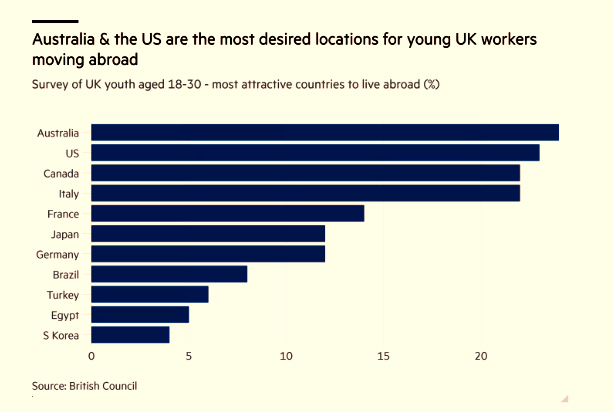

A recent British Council study found nearly three-quarters of 18 to 30-year-olds in the UK would consider living and working in another country in the short or long term. Nearly two-thirds said their standard of living was worse than it was for their parents’ generation, and more than half cited low wages as the biggest challenge young workers faced.

Rob, a 31-year-old banker in London Rob would ideally like to work for a European bank, but like many UK nationals, fears his language skills are not good enough. Other readers attracted by the idea say they have hit a wall researching visas and work permits (see box below) or have found that popular destinations such as Australia have equally high housing costs. Many are drawn to the idea of earning a tax-free salary in the Middle East for several years and coming back to the UK with a ready-made housing deposit.

However, FT readers working in the Middle East urge caution, stressing the myriad ways of spending money in the playground of the rich. “People come to Dubai because they’ve seen the TV shows, but they don’t understand the maths of the expat lifestyle,” one says. “There is no security of employment out here,” warns another. “If you lose your job for whatever reason, your visa is cancelled and you have to leave immediately.”

Providing non-UK tax resident workers plan appropriately, experts say there should be no tax to pay on money they eventually repatriate to the UK. However, readers who have already moved overseas warn about the need to manage exchange rate risk.

Higher capital gains tax rates brought in at last October’s Budget have given British entrepreneurs and business owners itchy feet.

A UK national selling a £100mn stake in their business could face a £24mn capital gains tax (CGT) bill.

Other business-owning readers claim their decision to relocate was not solely because of UK tax rates, but other countries’ greater business dynamism. They say foreign governments show greater desire to attract start-ups and have more consistent tax policies.

Retiring abroad has always been popular, but tax advisers say that looming changes to the inheritance tax treatment of pensions have promoted a fresh wave of interest from clients in their 60s and 70s.

Advisers say plenty of older clients are exploring the possibility of retiring abroad to exploit the new provisions, although few have yet made a decision to leave. For those who decide to remain in the UK, routes to mitigate IHT such as using trusts or setting up a Family Investment Company are available. But readers worry the rules could change again. “Who knows what this government or next could do in the future?” one asks.

Tax advisers say European destinations such as Italy and Spain are the most popular with retirees, though several readers mention Cyprus and Malta as having particular IHT advantages.

Many older readers, meanwhile, say the biggest barrier to leaving the UK is emotional, rather than practical. Several say they have been held back by a spouse’s reluctance to leave friends and family — especially grandchildren.

read more in our Telegram-channel https://t.me/The_International_Affairs

9:58 16.11.2025 •

9:58 16.11.2025 •