EU industrial production declines, continuing its downward trend, amidst falling inflation and historically low unemployment, figures The European Statistical Monitor (Edition: March 2024):

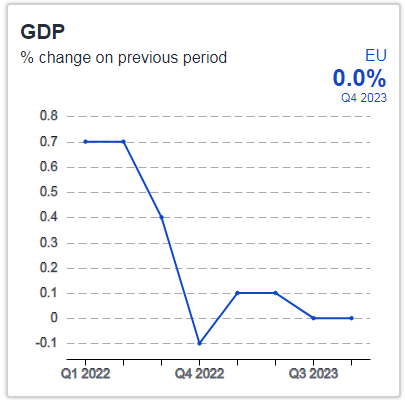

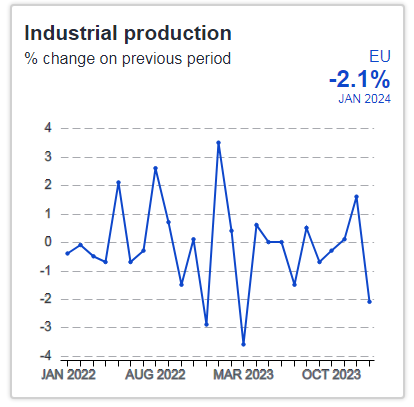

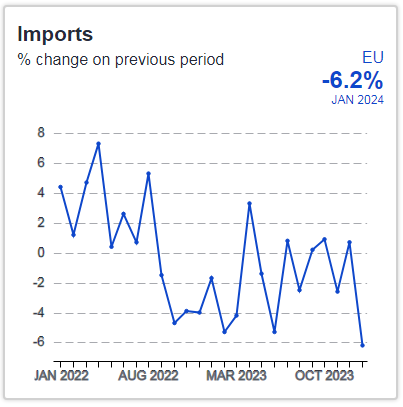

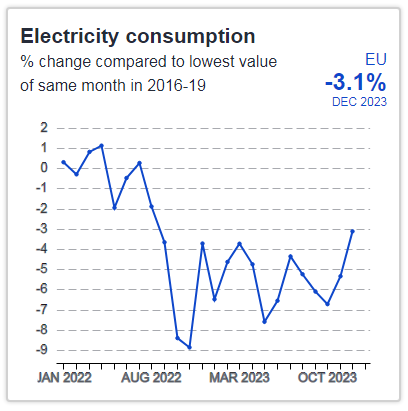

- EU retail trade rebounded in January 2024, while industrial production declined, following stable GDP in Q4 2023 (see Figure 1 and Figure 2). Additionally, production in services bounced back in December 2023. The lack of growth in GDP for two consecutive quarters, after modest gains in the first two quarters of 2023, indicates that the EU economy is on a weak footing. At the sectoral level, industrial production was marked by ongoing monthly fluctuations, with January falling below the 2021 level, indicating a sustained downward trend. Meanwhile, the rebound in retail trade in January occurred during prolonged fluctuations hovering below its 2021 level, largely due to high inflation negatively impacting consumer spending. On the other hand, the upturn in services production in December 2023 continued observed volatility that began in mid-2023, however remaining significantly above the 2021 level.

Industrial production declines

- Looking at monthly macroeconomic indicators, EU industrial production saw a month-on-month downturn at the opening of the year in January 2024, reversing the increase observed in December 2023, amidst ongoing sector fluctuations (see Figure 1). The 2.1% monthly decrease, sharply contrasting with the 1.6% increase observed in the previous month, pushed industrial production below its 2021 level. Overall the sector exhibited a marked year-on-year contraction of 5.7% in January 2024.

Across Member States, in January 2024 Poland stood out with a month-on-month increase of 13.3% in industrial output, followed by Slovenia (10.6%) and Lithuania (7.2%). In contrast, Ireland (-29.0%), Malta (-9.4%) and Estonia (-6.6%) saw the largest declines. The Irish industrial production index is significantly impacted by the global production of multi-national enterprises headquartered in Ireland, where they have located their intellectual property.

Production in services bounces back

- In December 2023, EU production in services rebounded, with a month-on-month increase of 0.4%, reversing the 0.3% decline observed in November 2023 (see Figure 1). This positive shift emerged amidst the broader volatility that began in June 2023. Prior to this, from a slow start in January 2023, the EU services sector showed a series of consistent month-on-month increases. These early gains ultimately underlay a year-on-year increase of 2.7% in December 2023. Production in services has consistently remained well above its 2021 level.

Looking at Member States’ production in services, in December 2023 Slovakia stood out with a month-on-month rise of 8.0%, followed by Latvia (2.7%) and Hungary (2.5%). In contrast, Poland (-2.2%) and Germany (-1.3%) were the only countries to record declines.

Retail trade rebounds

- In January 2024, the EU retail trade sector achieved a modest increase on a month-on-month basis, partially reversing the sharper decline observed in the previous month, continuing prolonged fluctuations over time hovering below the 2021 level (see Figure 1). There was a 0.3% rise in retail sales, after a 0.7% drop in December 2023. Nevertheless, on a year-on-year basis, the sector saw a contraction of 0.6% in January 2024, largely due to high inflation negatively impacting consumer spending.

Among Member States, Luxembourg led with a substantial month-on-month increase of 7.6% in January 2024. Romania and Cyprus followed with rises of 3.8% and 1.5%, respectively. Conversely, Estonia saw the most significant decline at 2.6%, with Slovakia and Latvia recording drops of 1.0% and 0.8%, respectively.

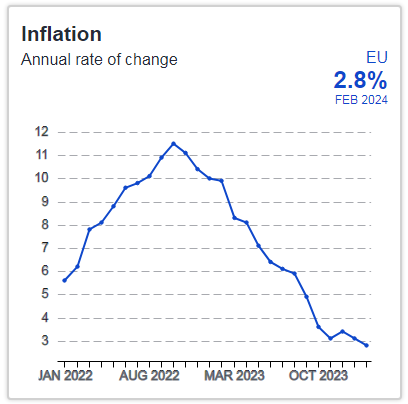

Inflation continues to fall

- In February 2022, EU annual inflation fell further to its lowest level since July 2021, primarily due to falling energy prices (see Figure 3). The EU annual inflation rate dropped to 2.8% in February 2023 from 3.1% in October. A year earlier, the rate was 9.9%.

Economic sentiment weakens slightly

- In February 2024, EU economic sentiment weakened slightly, contrasting with January's stability and the gradual improvements observed in the preceding months. The European Commission’s Economic Sentiment Indicator (ESI) dropped month-on-month by 0.4 points to 95.4 in February 2024. This decrease was due to lower confidence among services, retail trade and construction managers, while confidence remained broadly stable in industry and increased slightly among consumers. February’s modest decline contrasts sharply with December 2023’s significant 1.8-point increase, building on the consistent yet modest gains of 0.4 points seen in both October and November 2023. This development shapes a narrative of restrained optimism, given the ESI's shortfall from its long-term average of 100.

Across Member States, a notable contrast in economic sentiment is apparent. In February 2024, Croatia (109.6), Greece (104.8) and Bulgaria (103.5) recorded the highest ESI values, indicating a more optimistic economic climate. Conversely, Estonia (81.7), Finland (86.8) and Austria (88.2) reported the lowest ESI values.

read more in our Telegram-channel https://t.me/The_International_Affairs

11:46 12.04.2024 •

11:46 12.04.2024 •