Germanium exhibits a notable combination of the highest refractive index and minimal optical dispersion.

Germanium exhibits a notable combination of the highest refractive index and minimal optical dispersion.

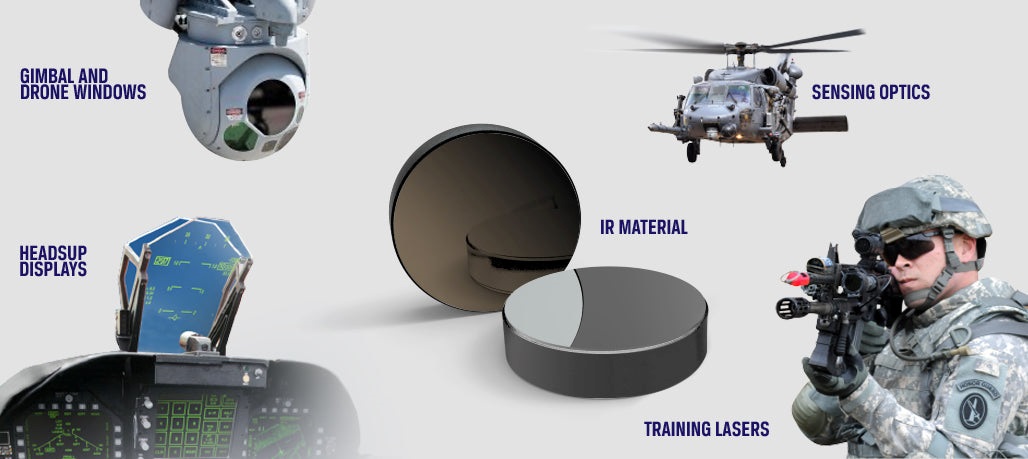

Photo: escooptics.com

Prices for material used for thermal imaging systems in military equipment at 14-year high, ‘Financial Times’ reveals.

Chinese export restrictions on germanium, a metal crucial for the defence industry, have created a “desperate” supply crunch and pushed prices to their highest level in at least 14 years, traders say.

Germanium is essential to the production of thermal imaging systems used in military equipment, including fighter jets. But its production is heavily dominated by China and companies do not typically hold large stockpiles.

China said in 2023 that it would halt the export of germanium, gallium and antimony following restrictions by the US and the Netherlands on advanced chips and chipmaking equipment. However, traders and analysts said exports started to nosedive in earnest from the end of 2024 onwards.

Terence Bell, of minor metals trader Strategic Metal Investments, said he had been unable to buy germanium for at least six months, with shipments from China having “completely dried up”.

“I spent my whole summer taking 2-3 [enquiries] a day from companies looking for germanium,” he said. “It’s desperate out there.”

Germanium imports to the US from China fell about 40 per cent between January and July compared with the same period in 2024, according to an analysis of trade data by Silverado Policy Accelerator, a non-profit organisation.

As of Wednesday, the price of germanium had risen to almost $5,000 per kilogramme, compared to just over $1,000 at the start of 2023, according to price reporting agency Fastmarkets. The September price is the highest ever recorded by Fastmarkets, in data going back to 2011.

Christian Hell, of trading house Tradium, said germanium demand was “through the roof”, with requests coming mostly from the US and Europe.

“Almost everybody is approaching us” and there was “panic” in the market, with Tradium unable to fulfil “all the enquiries we’re getting”, he said.

The Chinese restrictions have “devastated the ability for there to be a functioning spot market”, said Aaron Jerome, a trader at Lipmann Walton & Co. “People we used to be able to buy 100kg from, we’re lucky now if they can give us 10kg, and the price is three to four times higher.”

Like rare earth elements, germanium is economically and practically challenging to extract rather than globally scarce. It is commonly produced as a byproduct of zinc and coal fly ash.

Russia has historically been a supplier of germanium, but sanctions imposed on the country following its full-scale invasion of Ukraine have contributed to supply shortages in the west.

Global germanium demand is about 180 to 200 tonnes a year, according to Fastmarkets.

read more in our Telegram-channel https://t.me/The_International_Affairs

9:41 21.09.2025 •

9:41 21.09.2025 •