We appear to be moving swiftly to a bipolar world dominated by two superpowers: China and the United States, writes Jeff D. Colgan, an associate professor of political science at Brown University in “Foreign Policy”.

The ongoing energy conflict between Russia and the West means that period of multipolarity is now over.

Though Russia’s arsenal of nuclear weapons will not go away, the country will find itself a junior partner to a Chinese-led sphere of influence. The relatively small impact of the energy crisis on the U.S. economy, meanwhile, will be cold comfort for Washington geopolitically – the withering of Europe will ultimately degrade the power of the United States, which has long counted the continent as a friend.

Until 2021, Europe (including the United Kingdom) depended on Russian imports for about 40 per cent of its natural gas as well as a sizable share of its oil and coal needs.

Now European electricity and natural gas prices are now close to 10 times their historical average in the decade leading up to 2020. Europe’s energy costs approximately 2 per cent of GDP in normal times, but it has soared to an estimated 12 per cent on the back of surging prices.

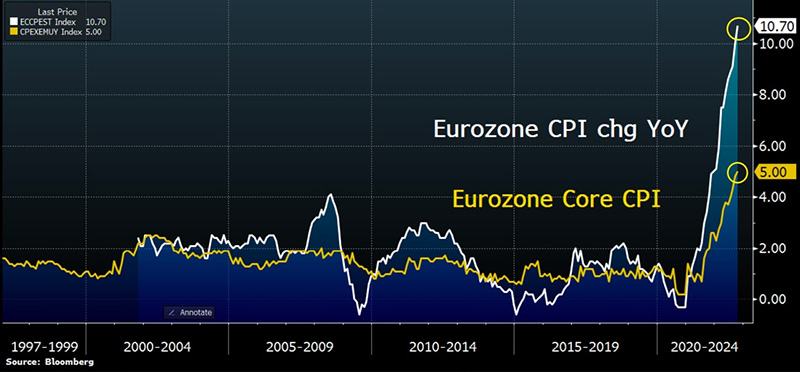

Rising inflation in the Eurozone:

High costs of this magnitude mean that many industries across Europe are scaling back operations or shutting down completely: aluminium manufacturers, fertilizer producers, metal smelters, and glassmakers are especially vulnerable to high natural gas prices. This means Europe can expect a deep recession in the coming years, though economic estimates of exactly how deep vary.

Instead, the real risk the continent faces is loss of economic competitiveness because of slow economic growth.

Though renewables like solar and wind can eventually replace fossil fuels in providing cheap electricity, they cannot easily supplant natural gas for industrial uses — especially since imported liquefied natural gas (LNG), a frequently touted alternative to pipeline gas, is considerably more expensive.

The bad news for Europe compounds a preexisting trend. Since 2008, the EU’s share of the global economy has declined.

As recently as 2005, the EU accounted for as much as 20 percent of global GDP. If the 2023 winter is cold and the coming recession proves to be severe, Europe’s share of global GDP could fall even faster.

Worse still, Europe lags far behind other powers in terms of military strength. European countries have skimped on military spending for decades and cannot easily make up for this lack of investment. Any European military spending now — to make up for a lost time — comes at an opportunity cost for other parts of the economy, potentially creating a further drag on growth and forcing painful choices about social spending cuts.

Europe’s energy crisis is unlikely to stay in Europe. Already, demand for fossil fuels is driving up prices around the world. The consequences will be especially hard on low-income energy importers in Africa, Southeast Asia, and Latin America.

The bottom line for world politics is that we are moving toward a world where China and the United States are the two paramount world powers.

The sidelining of Europe from world affairs will hurt U.S. interests. Europe is — for the most part — democratic, capitalist, and committed to human rights and a rules-based international order.

To the extent that the economic heft of Europe now declines, the United States will face stiffer resistance to its vision for a broadly democracy-favoring international order, concludes Jeff D. Colgan.

…It seems that the United States has begun to understand that the decline of the European Union will have a negative impact on the United States itself. But it's too late – the process has begun, and it can no longer be stopped.

read more in our Telegram-channel https://t.me/The_International_Affairs

15:53 05.11.2022 •

15:53 05.11.2022 •