Financial markets across most asset classes collapsed in value this morning as the realization of global conditions engineered by the globalistas finally forced its way into the mindset of traders across the planet.

Finally.

Global war, the collapse of the Bretton-Woods financial system that was created after WWII then destroyed by Davos and their political minions, and a looming severe recession or worse can no longer be ignored.

Even crypto participated in the revaluation with reality as BTC broke below $50,000 for the first time in a long time.

The irony is the collapse is happening right before the November election, a perfect end to the Biden presidency*, that was illegitimate in the first place.

As someone who has seen many bear markets in my lifetime, and who has written books and warned against this development, my sense is we are just getting started.

This is going to get a lot worse before it gets better.

A fear is sweeping markets everywhere. How quickly the mood turns. Barely a fortnight ago stockmarkets were on a seemingly unstoppable bull run, after months of hitting new all-time highs. Now they are in free fall, notes ‘The Economist’. American and Japanese indices have taken a battering. So have banks and gold.

America’s NASDAQ 100 index, dominated by the tech giants that were at the heart of the boom, has fallen by more than 10% since a peak in mid-July. Japan’s benchmark Topix index has clocked losses well into the double digits, dropping by 6% on August 2nd alone — its worst day since 2016 and, following a 3% decline on August 1st, its worst two-day streak since 2011.

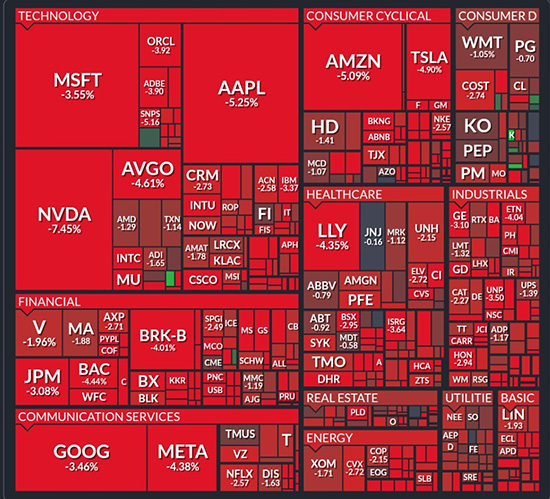

Share prices elsewhere have not been bludgeoned quite so badly, but panic is sweeping through markets (see chart 1).

Look beneath the surface, at individual sectors and firms, and the mood is even wilder. The Philadelphia semiconductor index, which tracks companies in the chipmaking supply chain globally, has fallen by more than a fifth in a matter of weeks. Arm, one such firm, has lost 40% of its market value. The share price of Nvidia, the previous bull run’s darling, has been flailing. In the three days from July 30th it dropped by 7%, soared by 13%, then dropped by 7% again. On August 2nd the value of Intel, another chipmaker, plunged by more than a quarter. And it is not just the semiconductor industry. The kbw index of American banking stocks has fallen by 8% in a matter of days. The prices of Japanese bank shares have plummeted, too.

The things that are — or, at least, were — doing well are the boltholes investors dash to when terrified: gold, the Japanese yen and American Treasuries. Troublingly, though, even the gold price cratered on August 2nd, with a peak-to-trough drop of more than 2%. Gold is usually a hedge against exactly the sort of chaos in the air just now. That its price was driven down suggests investors may have been selling not because they wanted to, but because they had to raise cash quickly to meet margin calls elsewhere. If so, there is a risk that other fire sales and a self-reinforcing doom loop may follow.

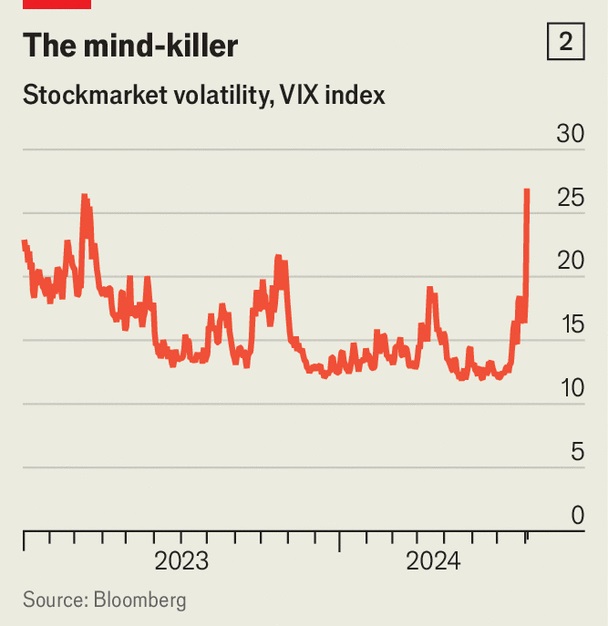

Wall Street’s “fear gauge”, the vix index, which measures expected volatility through the prices traders pay to protect themselves from it, has rocketed to its highest since America’s regional-banking crisis last year (see chart 2).

The artificial intelligence (AI), and especially the chipmaking industry that powers it, has been imbued with unrealistically high hopes. The biggest swings in American share prices came during a ten-day period in which five tech giants — Alphabet, Amazon, Apple, Meta and Microsoft — released results that left their shareholders crestfallen. Even Alphabet and Microsoft, whose revenues beat analysts’ expectations, saw their share prices fall the day after they reported. Those of Amazon, which undershot such expectations, were punished far more. The across-the-board battering suggests investors’ former euphoria over all things ai is evaporating.

That has an immediate knock-on effect for chipmakers which, if ai investment retrenches, may not be facing limitless demand for their products after all.

The first question now is whether — somewhere amid the chaos — an asset’s price has swung sharply enough to imperil an outfit that is heavily exposed to it. On that front, the decline in the gold price, and those of bank stocks, is ominous, notes ‘The Economist’.

Intel corp. is on the brink of disaster – stock market losses are monstrous!

Intel corp. is on the brink of disaster – stock market losses are monstrous!

The US economy may have just entered a recession, states ‘The Business Insider’.

According to data from the Bureau of Labor Statistics released Friday, the unemployment rate rose to 4.3% in July, up from 4.1% in June and from recent lows of 3.4% in April 2023.

The increase officially triggered the Sahm Rule — a recession indicator developed by the former Federal Reserve economist Claudia Sahm — which says that the US economy is in a downturn when the three-month moving average of the unemployment rate rises by 0.5% from its 12-month low.

The gauge has a perfect track record through at least the past nine recessions.

In addition to downcast labor-market data, the ISM Manufacturing Index fell further into contraction territory this week, signaling that US manufacturing continues to slow. Job openings are also trending downward, sitting at 8.1 million in June compared with 12.1 million in March 2022.

Investors are having a tough time digesting the downbeat economic data this week. The S&P 500 is down 5.6% from mid-July highs, while the Nasdaq 100 has fallen 10.8% from its July 10 top.

Where stocks go from here depends largely on how resilient the labor market proves in the months ahead as the Fed prepares its plan of action for its September meeting. Many strategists urged investors not to overreact to July's jobs data.

"While worries of a policy mistake are rising, one negative miss shouldn't lead to overreaction," said Lara Castleton, the US head of portfolio construction and strategy at Janus Henderson Investors.

read more in our Telegram-channel https://t.me/The_International_Affairs

11:44 06.08.2024 •

11:44 06.08.2024 •