Pic.: Americans for Prosperity

Pic.: Americans for Prosperity

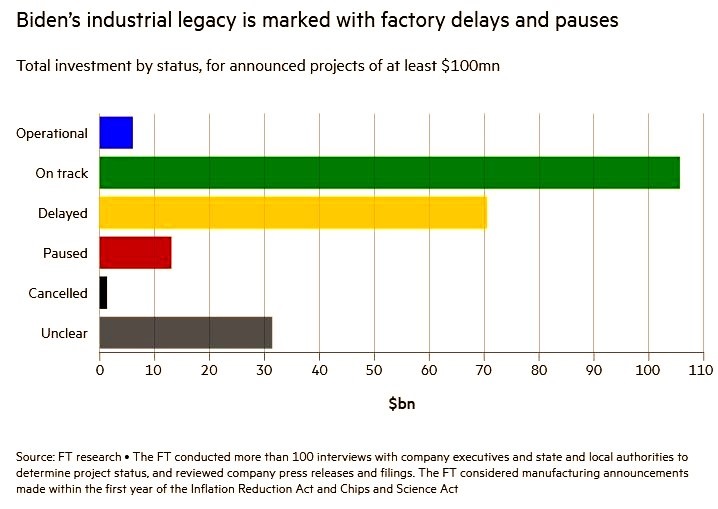

FT research shows that $84bn of initiatives announced in first year of the IRA and Chips Act have experienced slowdowns, notes ‘Financial Times’.

Some 40 per cent of the biggest US manufacturing investments announced in the first year of Joe Biden’s flagship industrial and climate policies have been delayed or paused, according to a Financial Times investigation.

The US president’s Inflation Reduction Act and Chips and Science Act offered more than $400bn in tax credits, loans and grants to spark development of a US cleantech and semiconductor supply chain.

However, of the projects worth more than $100mn, a total of $84bn have been delayed for between two months and several years, or paused indefinitely, the FT found.

The total value of the 114 large projects tracked by the FT was $227.9bn.

Companies said deteriorating market conditions, slowing demand and lack of policy certainty in a high-stakes election year have caused them to change their plans.

The delays raise questions around Biden’s bet that an industrial transformation can deliver jobs and economic returns to the US, which has offshored its manufacturing for decades.

They could also complicate efforts by vice-president Kamala Harris to use the administration’s record on manufacturing to attract blue-collar voters in November’s presidential election.

The FT conducted more than 100 interviews with companies and state and local authorities to determine the status of projects, in addition to reviewing corporate press releases and filings.

Among the largest projects on hold are Enel’s $1bn solar panel factory in Oklahoma, LG Energy Solution’s $2.3bn battery storage facility in Arizona and Albemarle’s $1.3bn lithium refinery in South Carolina.

Biden approved the Inflation Reduction Act and the Chips Act in August 2022 to revitalise the country’s Rustbelt and take on China in manufacturing the technologies required to digitise and decarbonise the US economy.

In the first year of the programme, more than $220bn in cleantech and semiconductor manufacturing investments were announced, with companies relocating projects from other countries to take advantage of the new subsidies.

But a tough macroeconomic backdrop, combined with overproduction in China, slowing demand for electric vehicles and policy uncertainty has chilled further progress.

“Everybody’s running into higher-than-expected costs just because of labour and supply chain,” said Craig McFarland, mayor of Casa Grande, Arizona.

An hour away from Casa Grande, Taiwan Semiconductor Manufacturing Company has delayed the start of production at its second fab — part of its $40bn project — by two years.

Its suppliers in the area have also reconfigured projects, with Chang Chun Group delaying its $300mn factory by two years and KPCT Advanced Chemicals putting its $200mn factory on hold.

Several solar panel manufacturers, including Maxeon, Heliene and Meyer Burger, have delayed their US factories in the past year following a collapse in global pricing driven by overproduction in Beijing.

Samkee, a Korean auto parts maker, delayed adding its electric vehicle lines in Alabama by one to two years.

Some of the delays are policy driven.

A potential Donald Trump victory in November’s presidential election has added to the uncertainty. While the bulk of IRA-related manufacturing investments have flowed to Republican-controlled districts, the law received no votes from party members in Congress. At campaign rallies the former president has vowed to “terminate” the IRA if elected.

read more in our Telegram-channel https://t.me/The_International_Affairs

9:20 17.08.2024 •

9:20 17.08.2024 •