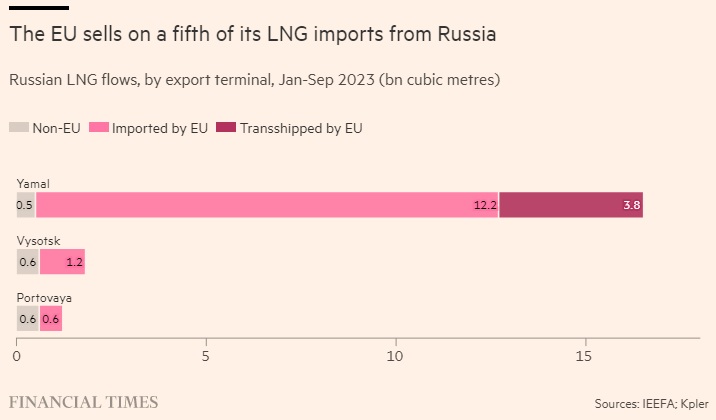

More than a fifth of Russia’s liquefied natural gas reaching Europe is reshipped to other parts of the world, a practice that boosts Moscow’s revenues despite the EU’s efforts to curb them, writes ‘The Financial Times’

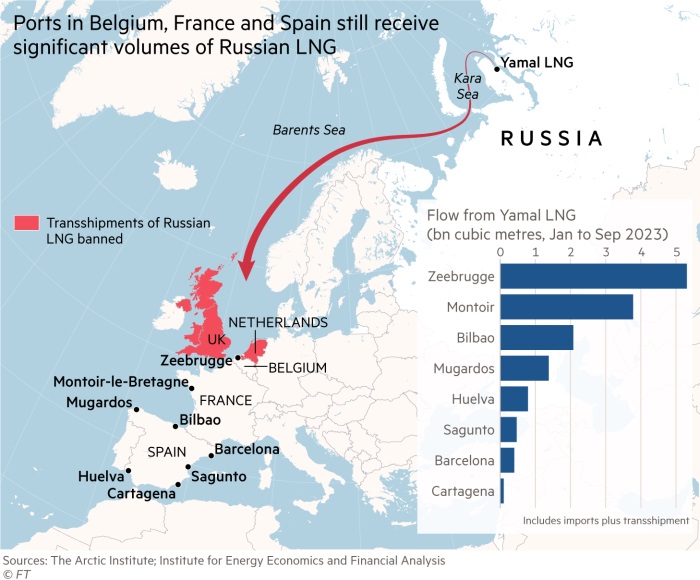

While contracts for so-called transshipment of Russian LNG have been banned in the UK and the Netherlands, data from 2023 suggests permitted Russian gas shipments are routinely transferred between tankers in Belgium, France and Spain before being exported to buyers in other continents.

The ship transfers are crucial for Russia as it attempts to make best use of its Arctic fleet. Transshipment usually takes place between Russian “ice class” tankers that are used to run between the Yamal peninsula and north-western Europe and regular LNG tankers that then sail on to other ports, freeing up the ice-class vessels to return north.

Ports in Belgium, Spain and France still receive significant volumes from the Siberian plant Yamal LNG, whose biggest shareholders are Russia’s second-largest natural gas producer Novatek, China National Petroleum Corporation and the French energy company TotalEnergies.

Of the 17.8bn cubic metres of Russian liquefied natural gas flowing to the EU between January and September this year, 21 per cent was transferred to ships destined for non-EU countries including China, Japan and Bangladesh, according to data from the Institute for Energy Economics and Financial Analysis, a think-tank.

Zeebrugge in Belgium and Montoir-de-Bretagne in France received the most Russian LNG of all EU ports in 2023.

Unlike coal and oil, Russian gas has not been placed under sanctions by the EU but the European Commission has said member states should rid themselves of Russian fossil fuels by 2027.

Ana-Maria Jaller-Makarewicz, lead energy analyst at IEEFA, noted that while volumes of LNG transshipments in Europe had fallen since Russia’s full invasion of Ukraine in 2022, they remained significant and potentially had been overlooked. “The EU is not thinking about [it] when they are talking about a ban,” she said. “They don’t count a transshipment.”

Amund Vik, former Norwegian state secretary for energy and adviser to the consultancy Eurasia Group, said EU governments were caught in a bind. Member states would find it “hard to bang the drum [against] exporting [Russian LNG] elsewhere if they are using it themselves”, he said. “You will see them tiptoeing around this topic this winter.”

The EU previously imported 155bn cubic metres of piped gas from Russia, about 40 per cent of its total supply. To replace that gas, the bloc has vastly increased its imports of LNG from countries including the US, Norway and Qatar. But the EU is also set to import record volumes of the super-chilled fuel from Russia this year.

EU policymakers have defended the continuation of imports from Russia as being due to long-term contracts agreed before the war that, if broken, would force European companies to pay compensation to Russia. The Belgian natural gas company Fluxys has, for example, a 20-year contract with Yamal that ends in 2039.

The Belgian energy ministry said it was “determined to tackle this issue” and was “gathering intelligence on effective approaches”. “We recognise the importance of finding a way that does not endanger the security of supply of the European continent,” a spokesperson added.

read more in our Telegram-channel https://t.me/The_International_Affairs

10:31 03.12.2023 •

10:31 03.12.2023 •