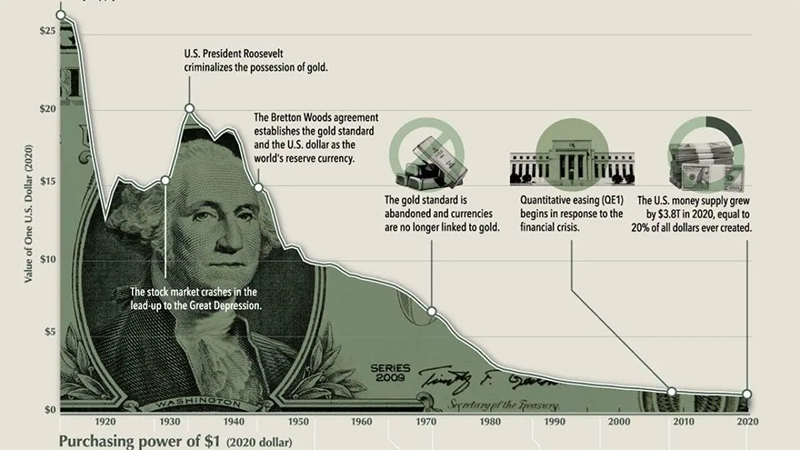

The value of a dollar in 2020 is much lower than it was in the early 20th century. Comparisons through the decades show what drove the dollar down.

The value of a dollar in 2020 is much lower than it was in the early 20th century. Comparisons through the decades show what drove the dollar down.

Pic.: binance.com

Officials in Washington explore how to encourage more countries to adopt greenback as their primary currency, ‘Financial Times’ reveals.

Trump administration officials are discussing ways to encourage other countries to adopt the dollar as their primary currency to counter a China-led charge to erode the greenback’s global dominance.

Staff from government departments — including the Treasury and the White House — met Steve Hanke, a professor at Johns Hopkins University and a leading expert on dollarisation, over the summer to discuss how the administration could promote the policy.

“This is a policy they are taking very seriously, but it is in progress. No final decisions have been made yet,” Hanke told the Financial Times.

Talk about dollarisation comes amid US involvement to try to calm a market crisis in Argentina. Some policymakers and economists view the Latin American economy as a prime candidate for dollarisation due to frequent losses of confidence in the peso — even though both the US and Argentina say it is not actively under consideration.

Administration officials have, however, become concerned by a push led by Beijing for emerging markets to use the dollar less in cross-border transactions.

Hanke said a figure he described as a “political personality” with links to the White House outlined those concerns at a meeting in late August.

“[The political personality] made clear what was already clear to me: there was a group high up within the administration that was interested in bolstering the international role of the dollar,” Hanke said, adding that the interest in dollarisation was “in the same space” as the administration’s push for broader use of dollar-backed stablecoins.

While the discussions began in August and predate the US Treasury’s extension of a $20bn financial lifeline to Argentina, Hanke told officials he believed the Latin American country would be one of the obvious candidates for the policy, along with Lebanon, Pakistan, Ghana, Turkey, Egypt, Venezuela and Zimbabwe.

Argentina maintained a “currency board” peg to the dollar from 1991 to 2002 but it collapsed after the country’s catastrophic 2001 default.

Hanke, who has spent much of career advising on dollarisation, remains in regular contact with administration officials. But he says that the recent Argentine crisis has not sparked an intensification of discussions.

Dollarisation has often been touted as a fix to Argentina’s repeated currency crises and was a core campaign pledge for libertarian Javier Milei before 2023’s presidential election. Argentina’s economy minister Luis Caputo earlier this month ruled out dollarisation as a short-term option, saying the country did not have the dollar reserves to make it work, but did not reject the idea outright.

Others also tout dollarisation as a potential solution for Argentina. “That’s what has to happen if you want to break the cycle,” said Jay Newman, a key figure in hedge fund Elliott Management’s long battle with Argentina for a payout on its defaulted debt. “Otherwise every time you put dollars into the economy they get sucked out by the oligarchy and everybody who has an offshore bank account.”

Other smaller Latin American economies, such as Ecuador and El Salvador, already use the dollar. However, the IMF believes dollarisation would condemn Argentina to low growth, by forcing it to adopt the US Federal Reserve’s monetary policies.

read more in our Telegram-channel https://t.me/The_International_Affairs

10:20 14.11.2025 •

10:20 14.11.2025 •