Photo: static.producer.com

Canadian Green Party leader Elizabeth May told the Commons that farmers are committing suicide because of ‘climate change’.

“I think we focus a lot on the carbon tax in this place without looking at the climate crisis and the real impact that has on Canadian farmers,” May said. “We really want to support the family farm,” she added.

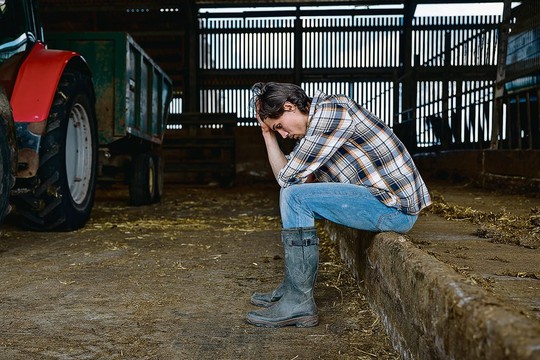

“We know people living on farms are experiencing suicide because it is an extremely difficult life right now.”

Through 2030, farmers would save almost $978 million if Bill C-234, An Act to amend the Greenhouse Gas Pollution Pricing Act, became law and exempted various fuels from the carbon tax.

Conservative MP Lianne Rood, whose speech prompted the claim from May, stressed high taxes were a leading stressor for farmers. She supported ending the carbon tax on farmers to save them $122 million annually.

“We need to bring taxes down for farmers,” said Rood. “Axe the carbon tax so farmers have a reprieve in Bill C-234 especially. If we can pass Bill C-234 unamended then that will help our farmers.”

On April 1, the federal carbon tax will increase to $95 per tonne and will continue to rise by $15 annually until 2030.

The Senate, facing pressure from cabinet and Prime Minister Justin Trudeau, removed fuel exemptions for heating buildings used to raise and house livestock or crops. Most Trudeau appointees to the Senate have never opposed a Liberal measure.

May said outright that further carbon tax exemptions would “ignore the biggest economic threat” to farmers, which she claimed is the “climate crisis.” She says more droughts, aridification, and floods will impact their bottom line and jeopardize the environment.

“We are facing something as dire as the loss of civilization,” May earlier told reporters.

Rood, during her parliamentary speech, contends the government is driving farmers to the “breaking point.” Fertilizer costs (80%) and fuel (78.5%) are up considerably in recent years, followed by feed (29%), machinery (20%), sheds (13%), and pesticides (7%).

The average livestock farmer can expect a $726 carbon tax bill every month, while crop farmers can look forward to a $2,024 bill, according to the Agriculture Carbon Alliance (ACA). The coalition of 15 farm associations has tirelessly pushed Ottawa to provide meaningful tax relief to farmers.

“That’s a lot of money that farmers are paying on their bills every month,” said CTF Prairies Director Gage Haubrich, who adds they can no longer compete with U.S. farmers owing to the carbon tax.

“If farmers aren’t paying millions of dollars every year in the carbon tax, it’s likely to help the rest out with prices at the grocery store.”

Greenhouses are the worst off, with an average carbon tax bill of $17,173. In some cases, up to 40% of a farmer's energy cost is just carbon tax.

The current policy needs to recognize that the carbon tax harms food affordability and farm margins, according to the Agricultural Producers Association of Saskatchewan (APAS). “Saskatchewan farms [will] pay over $40 million in carbon tax just to get their products to port,” said Ian Boxall, its president.

“Farmers will pay more in barn heating or grain drying each month than they will ever see in rebates. We see these costs in our monthly bills and feel them trickle down,” he added.

The APAS clarified there are “no available” fuel alternatives with current technology.

read more in our Telegram-channel https://t.me/The_International_Affairs

10:18 07.12.2024 •

10:18 07.12.2024 •