As I look at the world over the decades, I see incredible progress, but also unfulfilled dreams. The average person today is much better off than, say, 30 years ago, but the averages conceal deep undercurrents of marginalization, discontent, and hardship, Kristalina Georgieva, Managing Director, IMF notes.

Many people in many places — especially the young — are taking their disappointment to the streets: from Lima to Rabat, from Paris to Nairobi, and from Kathmandu to Jakarta, all are demanding better opportunity.

In the U.S. chances of growing up to earn more than your parents keep falling. Here too, discontent has been evident — and has helped precipitate the policy revolution that is now unfolding, reshaping trade, immigration, and many international frameworks.

All of this plays out against a backdrop of deep transformations: in geopolitics; in technology; in demographics, with populations surging in some places and shrinking in others; and in the mounting harm we do to our planet.

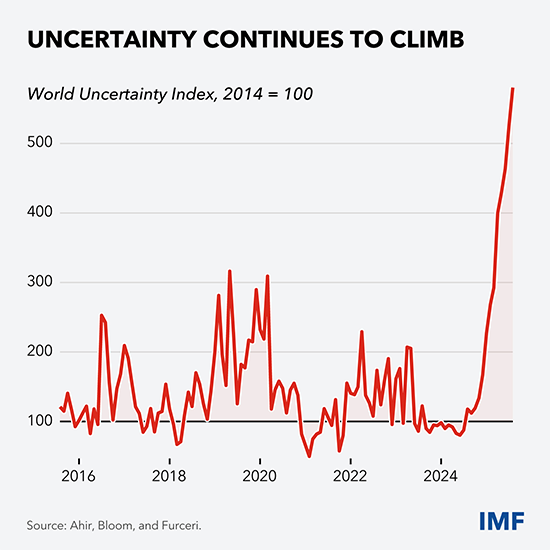

The result is exceptionally high uncertainty: globally it has shot up and continues to climb. Buckle up: uncertainty is the new normal and it is here to stay.

Next week, as the world’s finance ministers and central bank governors gather at our Annual Meetings, the most pressing questions will be about the global economic impact of these forces of transformation and the policy turbulence we are seeing.

How is the world economy coping? Short answer: better than feared, but worse than we need.

When we met in April, many experts — not us — predicted a U.S. recession in the near term, with negative spillovers to the rest of the world. Instead, the U.S. economy as well as many other advanced and emerging markets, and some developing countries, have held up.

As our World Economic Outlook will explain next week, we see global growth slowing only slightly this year and next. All signs point to a world economy that has generally withstood acute strains from multiple shocks.

How do we explain this resilience? I would point to four reasons:

- One, improved policy fundamentals;

- Two, private sector adaptability;

- Three, less severe tariff outcomes than initially feared — for now; and

- Four, supportive financial conditions — for as long as they hold.

First reason: better policy fundamentals and global coordination.

In many parts of the world, sustained efforts have delivered more credible monetary policy, deeper local currency bond markets, new fiscal rules, and — during the pandemic—swift, decisive, and globally coordinated fiscal action to limit the immediate pain and the lasting scars.

Emerging market economies, especially, have significantly upgraded their policy frameworks and institutions. We just put out a report on progress, quantifying the gains. These economies now perform better when shocks strike than before the global financial crisis.

Good policy makes a difference.

Second reason for resilience: private sector adaptability. Just look at private initiative in world trade: companies have been frontloading import orders in advance of tariff hikes and reorganizing their supply chains.

Corporate balance sheets are generally strong after years of robust profits, reflexes are quick after the dry runs of shock after shock, artificial intelligence is becoming mainstream, and change is faced as a challenge and embraced as an opportunity.

Third reason: tariffs, where the shock has not been as large as initially announced.

The U.S. trade-weighted tariff rate has fallen from 23 percent in April to 17½ percent now — still much higher than before. The U.S. effective rate is now far above the rest of the world’s, which has held relatively steady this year, with very few cases of retaliation.

In short, the world has avoided a tit-for-tat slide into trade war — so far. But openness has nonetheless taken a big hit.

Fourth reason: supportive financial conditions. Fired up by optimism about the productivity-enhancing potential of AI, global equity prices are surging. This, plus tight risk spreads, leaves funding markets generally wide open — and the dollar’s slide earlier this year gives precious relief to non-U.S. borrowers with dollar-denominated debt.

So there we have it: four factors behind the economic resilience we have seen this year.

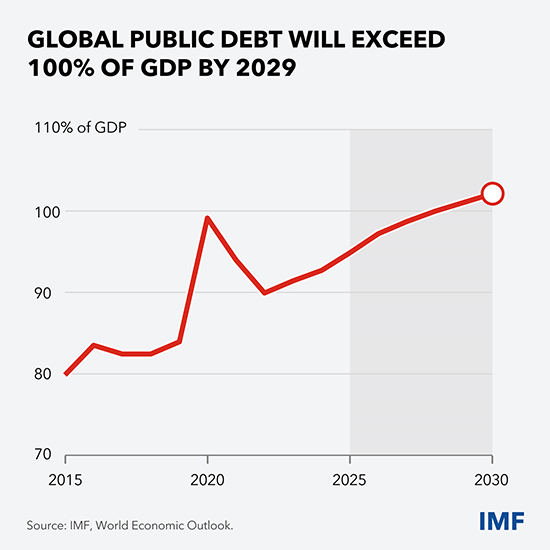

…Let me now turn to fiscal affairs, starting with the sobering reality that global public debt is projected to exceed 100 percent of GDP by 2029, led by advanced and emerging market economies.

Rising debt inflates interest payments, exerts upward pressure on borrowing costs, constrains other spending, and reduces governments’ ability to cushion shocks.

One casualty is advanced economies’ development assistance to the world’s neediest countries, which continues its regrettable decline. For the low-income countries on the receiving end, this means more self-help — including setting a minimum tax-to-GDP target of 15 percent.

Fiscal consolidation is necessary in countries rich and poor alike, Kristalina Georgieva said.

…So, today my parting words are these: if we all pull together in this complex and uncertain world, we can deliver good policies that underpin free markets with smart regulations, strong institutions, reliable data and robust safety nets — policies with the power to further increase resilience and accelerate growth.

read more in our Telegram-channel https://t.me/The_International_Affairs

10:39 11.10.2025 •

10:39 11.10.2025 •