Moscow’s wartime oil adaptations in the wake of Russia’s energy war reveal a great deal about building resilient energy systems, ‘The National Interest’ stresses.

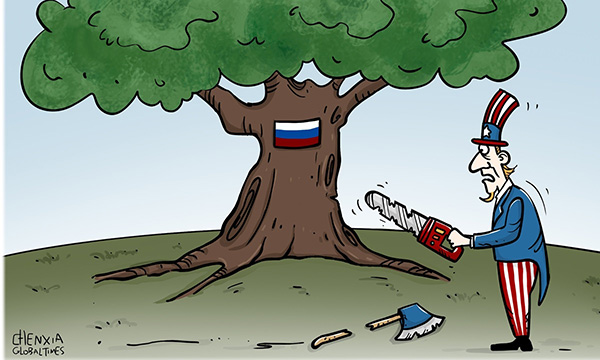

At the G7 Summit in Canada this past June, leaders recommitted to enforcing sanctions on Russian oil exports, acknowledging that loopholes and lax enforcement have allowed Moscow to sustain its wartime revenues. More than three years into the war, Russia has adapted with surprising effectiveness — rerouting crude to new buyers and leveraging global demand to keep its financial lifeline intact.

While sanctions have hurt Russia, they have not been crippling. The Kremlin’s ability to stabilize its wartime economy through domestic production, capital controls, and alternative trade networks offers an important lesson for Western policymakers: sanctions alone are insufficient to isolate a major oil producer without rigorous enforcement, market agility, and a clear-eyed understanding of how energy can be weaponized in both directions.

Supply diversification, strategic reserves, and the International Energy Agency’s (IEA) oil sharing system remain key to ensuring Western energy security. But the war has highlighted the risks of relying on a single energy supplier and forced Western capitals to rethink their energy security strategies. This was a new kind of supply shock — not a disruption of oil flows from the Middle East, but a self-imposed crunch via sanctions on a major supplier. Moscow’s ability to navigate global energy markets under pressure is a classic case study in resilience — and shows that the Russian system should not be underestimated.

Long thought to be dependent on Western technology, markets, and finance, Russia has kept oil exports moving, revenues flowing, and much of its financial system intact. A May 2025 BBC report noted that since February 2022, Russia earned over three times as much from hydrocarbon exports as Ukraine received in aid.

The lesson isn’t that Russia is energy-invincible—it’s that a sanctioned state can retool market tools, logistics, and financial systems to maintain leverage. Western policymakers must learn from Moscow’s tactics to build more transparent energy systems and devise effective measures to counter future threats to their security.

Speed was Russia’s greatest asset. Moscow facilitated the switch with tax breaks, export tweaks, and freight subsidies. But the real agility came from private actors under Russian control moving faster than Western governments were able to act. It wasn’t just big companies such as Lukoil and Rosneft, but smaller trading firms operating under the radar that were able to act decisively.

Russian producers organized a “shadow fleet” of aging tankers sailing under flags of convenience, often without insurance and with transponders off. This allowed crude exports to bypass European markets and reach buyers in China, India, and elsewhere who were not participating in sanctions and were eager to buy cheap oil under the “price caps.” This led to the unintended consequence of third-party refiners laundering Russian crude and selling petroleum products back into the markets of the very countries that had sanctioned Russian oil.

Despite the imposition of increasingly tough sanctions on Russian oil in January 2025, China and India accounted for eighty-five percent of Russia’s seaborne crude exports as of May 2025, suggesting a long-lasting shift in the pattern of global oil trade. This pivot succeeded not through central planning, but through commercial adaptation. Exporters kept their windfall profits and used them to build new routes to Asia, even at the cost of short-term tax revenue. Moscow also benefited from OPEC+ production cuts that kept market prices elevated.

The West, meanwhile, has advantages—capital markets, data, insurance, and entrepreneurial scale—but these only become powerful when deployed in a coordinated manner. NATO, the EU, and the G7 have imposed targeted sanctions, but often too slowly and unevenly to maximize their effectiveness.

Sanctions aren’t silver bullets. They only erode the sanctioned nation’s economic capabilities over time. Russia’s workarounds have exposed enforcement gaps, not the futility of sanctions, as Moscow had learned a few tricks from enduring the lighter sanctions imposed after its annexation of Crimea in 2014.

Following the end of the Ukraine war, however it turns out, Russia’s energy sector will enter a new era with more challenges than opportunities. Although Russia will remain an energy exporter, the days of easy access to European energy markets are over, and expanding oil and gas exports to Asia will be a complicated task as the geopolitics of global energy trade will enter uncharted territory, especially if global warming enables Moscow to use the Northern Sea Route along the northern perimeter of Siberia to ship energy more directly.

read more in our Telegram-channel https://t.me/The_International_Affairs

11:24 30.07.2025 •

11:24 30.07.2025 •