Pic.: First Post

Investors are increasingly souring on the United States, as illustrated by the declining dollar, the stalled stock market and rising government borrowing costs, ‘The New York Times’ writes.

A new investment thesis has spread through global markets at the start of 2026, as trading strategies long built on the primacy of the United States now opt for a new approach: Sell America.

The sentiment started to take hold in financial circles after the shock of sky-high tariffs sent stocks and bonds into a tailspin last April, but it has taken off recently as the Trump administration has pursued policies like attacks on the Federal Reserve’s independence and threats of a new trade war with Europe that are worrying investors anew.

The “ex-America” trade was a strikingly common theme at New York Life Investments’ global investment meeting earlier this month, said Lauren Goodwin, an economist at the company.

“Our European colleagues were frankly stunned by the openness that U.S. investors have to diversify away from the U.S.,” she said.

Ms. Goodwin and other investors stress that the sell America trade is more about hedging existing U.S. exposure, diversifying into other assets and deciding where to invest new money, rather than an attempt to leave the country entirely.

The sliding value of the dollar

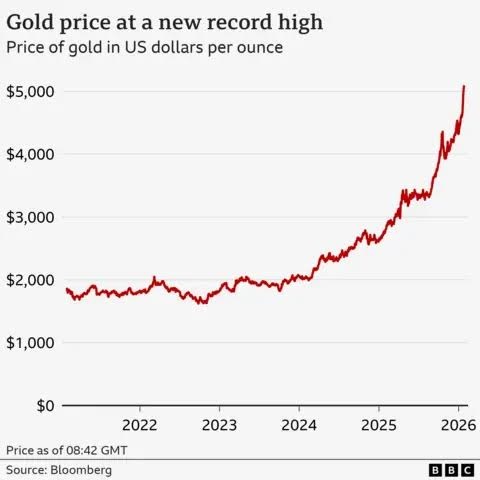

Over the past month, that trading has fueled the sliding value of the dollar, stalled the stock market’s rise, increased government borrowing costs and sent the prices for precious metals like gold soaring.

The nomination of Kevin Warsh to be the next chair of the Federal Reserve and a last-minute deal to fund most of the government helped the dollar on Friday. Yet the currency still ended the month 1.2 percent lower after its second straight week of losses, when measured against a basket of currencies including the euro, British pound and Japanese yen. By that same measure, the dollar is 10 percent lower over the past 12 months, a huge drop for the typically strong currency.

Gold and silver, which remain safe haven investments in times of turmoil, both hit record highs recently. And even after a sharp drop on Friday the precious metals are still up 24 and 19 percent for January, with the price of gold 75 percent higher over the past 12 months.

After a relentless rally, the U.S. stock market has plateaued since the start of the year and started to slide when measured in other currencies.

“It’s been almost a paradigm shift in the dollar,” said Adam Turnquist, chief technical strategist at LPL Financial. For international investors, the change is particularly acute. “U.S. equities were working as the dollar moved higher,” said Mr. Turnquist. “That’s unraveled.”

Purchases roughly doubling after Russia’s assets were seized

Those asset seizures prompted concerns that sovereign assets once thought safe from harm could become ensnared in geopolitics. The safety of U.S. assets “started to get reassessed,” said Ryan McIntyre, president of Sprott Inc, a large gold investor.

China’s holdings of U.S. Treasuries have been in decline for nearly a decade, following the Trump administration’s first trade offensive against the country, but the drop accelerated after February 2021, falling from $1.1 trillion to less than $700 billion toward the end of last year, according to data from the Treasury Department. Brazil began to cut its Treasury holdings in 2019, with the drop accelerating over the past year. India has also cut its holdings sharply over the past year.

To buy Treasuries requires dollars, and selling Treasuries removes the need to hold dollars, weakening the currency. There isn’t one fiat currency that has been the standout beneficiary as the dollar has fallen, said analysts. Instead, money has primarily flowed into gold and other precious metals. The value of gold has roughly doubled in price over the past 12 months.

Data from the World Gold Council shows central bank purchases roughly doubling after Russia’s assets were seized and then accelerating again at the end of last year.

read more in our Telegram-channel https://t.me/The_International_Affairs

11:29 05.02.2026 •

11:29 05.02.2026 •