Pic.: Shutterstock

Alliances sometimes begin by accident. Sometimes they end that way, too.

Especially when Donald Trump is involved, POLITICO notes.

It’s almost unthinkable in the age of Trump’s “American Energy Dominance” and the EU’s scramble to quit Russian gas that a desire for shiploads of U.S. gas was once unfashionable on both sides of the Atlantic.

Russian gas will always win on price, given the extra expenses for U.S. LNG: Compressing the gas into a liquid, loading it onto ships, hauling it across the Atlantic and then regasifying it for use on the continent.

But countries like Lithuania were willing to pay a premium for energy from an ally because of their history and because “they had a front row seat to Russia’s actions”.

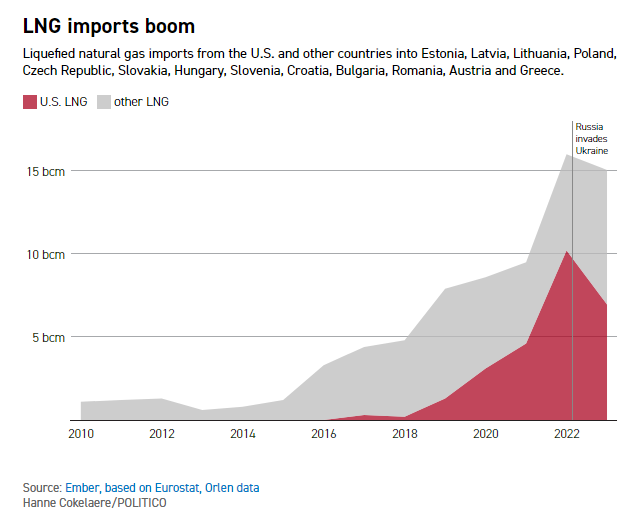

LNG imports booms from the U.S. and other countries into Estonia, Latvia, Lithuania, Poland, Czech Republic, Slovakia, Hungary, Slovenia, Croatia, Bulgaria, Romania, Austria and Greece.

If Trump wanted a poster child for unleashing American energy dominance, it doesn’t get much more compelling than Europe.

Trump even initially demanded that von der Leyen commit to $1 trillion in U.S. energy purchases during his term, the official said, before settling on $750 billion ($250 billion annually).

But the numbers are non-binding, hyperbolic and unrealistic. To reach that figure, the U.S. would have to divert all its energy exports to the EU — and then somehow find 50 percent more in supplies. Meanwhile, the EU would have to essentially ditch its other foreign suppliers (including those providing cheaper energy) and more than triple its U.S. imports.

And that’s assuming Europe has adequate infrastructure to receive all that U.S. fuel, which it does not. And that private companies would go along with the plan, which they can’t be compelled to honor.

Instead, insiders in Washington and Europe say it’s Trump himself who is jeopardizing the transatlantic love-in — including an LNG trade that was worth $20.3 billion in 2024 (according to trading platform Kpler) and that accounted for 53 percent of all U.S. LNG exports.

Trump’s overall unreliability as a partner — his tariffs, his taste for bullying, his open disparagement of the EU — make Europeans wary of swapping reliance on one strongman for another.

Despite pressure from Trump, most EU buyers have refused to sign long-term contracts with U.S. companies, against a backdrop of declining gas demand on the continent and more supply coming online from alternative exporters like Norway and Qatar.

Italian firm ENI and Virginia-headquartered exporter Venture Global broke that streak in July, striking a 20-year deal to supply LNG to the EU. Analysts immediately criticized the arrangement for reflecting the political priorities of the Italian government rather than market realities. That came shortly after Venture signed a similar contract with German company Securing Energy for Europe.

On top of this, people who have talked to the administration on energy and on European matters told POLITICO that tension exists between two factions: White House officials wanting to prioritize a peace deal, and officials on the National Energy Dominance Council — like Wright, the energy secretary, and Interior Secretary Doug Burgum — who warn that a peace deal letting Russian gas into Europe would reverse recent U.S. LNG gains.

For instance, a Trump-brokered peace deal could involve lifting U.S. sanctions on Russian LNG.

That “would be the Trump administration shoving Russian gas down the throats of the Europeans,” said one person familiar with the matter, granted anonymity to describe private discussions. “Europeans are saying a hard ‘no.’ They’re proud of what they've done in the past three years in getting off Russian gas.”

The message from Brussels is that a Russian energy reset is a non-starter. The European Commission has even proposed phasing out Russian gas by 2028 — although Moscow-friendly Slovakia and Hungary are holding up the plan.

Baltic nations — Latvia, Lithuania and Estonia — as well as Poland and the Nordic countries have been the strongest advocates for a long-term exit. Even though Trump might be sending conflicting signals, Eastern and Central Europeans are working to keep the doors wide open for American energy. Ignacy Niemczycki, a secretary of state and top adviser to Polish Prime Minister Donald Tusk, said the EU’s proposed Russian gas ban was thanks to “our pressure.”

Not everyone in the U.S. is convinced Europe can stay unified with cheap Russian energy on the table.

Stateside oil and gas companies are scenario-planning for what will happen to markets — including Europe’s — if Trump or the EU removes Russian sanctions, said one oil and gas executive who was granted anonymity to discuss internal deliberations. The executive said they do not believe that easing restrictions on Russia is imminent, but are nonetheless weighing the possibility.

Washington is also wary of Trump’s engagement with Putin and the potential impact on homegrown industry.

Some fear Trump’s penchant for spectacle and hyperbole will lead him to a peace deal with Russia that weakens Ukraine and undermines U.S. exports.

Oil and gas industry officials have begun warning the White House that normalizing relations with Russia would contradict Trump’s energy and economic agenda that centers on shipping more fossil fuels overseas. They cautioned that Moscow would almost certainly expect Washington to lift sanctions on its energy industry, allowing cheaper Russian LNG to undercut the U.S.

read more in our Telegram-channel https://t.me/The_International_Affairs

11:10 01.08.2025 •

11:10 01.08.2025 •