In the first half of 2024, Turkey has risen from being the 14th largest buyer of Russian crude oil before Russia’s full-scale invasion of Ukraine, to the third largest importer, writes ‘Energy and Cleanair’.

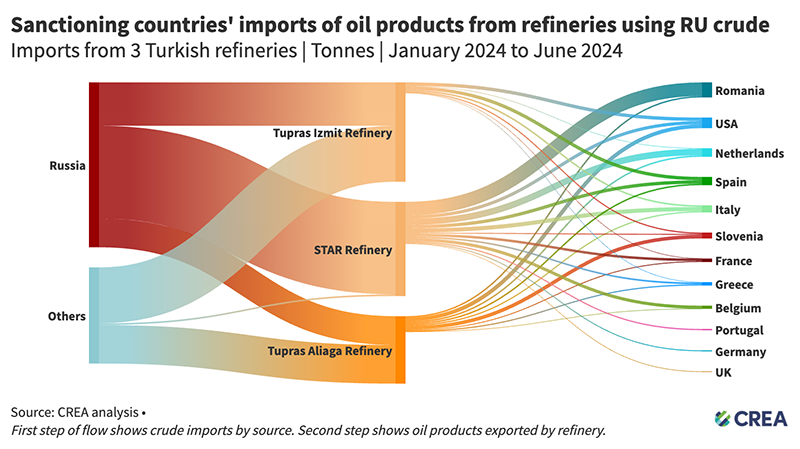

In the same period, three Turkish refineries have used EUR 1.2 bn worth of Russian crude to create oil products that are then imported by G7+ countries.

Imports of refined oil products from Turkey’s STAR Refinery, Tupras Izmit Refinery, and the Tupras Aliaga Izmir Refinery have generated an estimated EUR 750 mn in tax revenues for the Kremlin to finance its brutal war on Ukraine.

The Russian oil and gas sector is a crucial revenue stream for the Kremlin, contributing 32% to the federal budget in 2023, a decrease from 42% in 2022. Furthermore, the Kremlin allocated a third of all 2024 spending on the military.

The tax revenue received from imports by sanctioning countries of Turkish oil products made from Russian crude would enable Russia to recruit over 6,200 soldiers every month even after the new sign on benefits they are offering to those willing to fight in Ukraine.

While the loophole goes unchecked, G7+ countries have actually increased their imports from non-sanctioning countries taking advantage of the situation by simply switching their supplier from Russia to third countries that are essentially functioning as Russian middlemen merchants. Having discovered that Western countries are not concerned about the origin of the crude used to create products for them, non-sanctioning countries have switched suppliers and are now heavily dependent on Russian crude oil and indirectly supply Russian coffers.

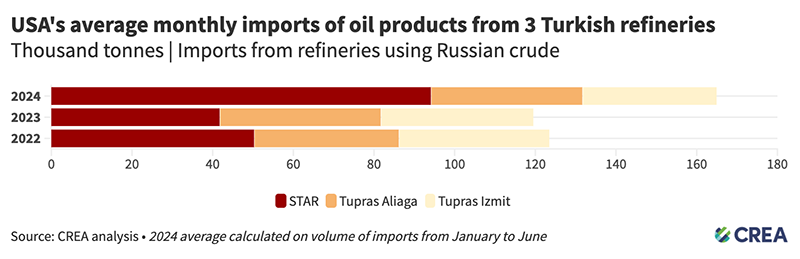

EU Member States’ imports of refined oil products from Turkish refineries remain the highest but it is the United States who is the second largest importer of refined oil products from these three refineries in the first half of 2024.

The USA’s imports from these refineries have risen an astronomical 335% year-on-year in the first six months of 2024, up to around 613,000 tonnes — already higher than their total oil products imports from them in 2023. CREA estimates that 386,000 tonnes of the imported refined oil products in the first half of 2024 were derived from Russian crude. These imports consist mostly of gasoline. The USA’s imports of gasoline from these refineries, estimated as being refined from Russian crude, could have filled up an estimated 338,782 American cars every month.

G7+ countries imported EUR 1.8 bn of oil products derived from Russian crude, from three refineries in Turkey in the first half (H1) of 2024.

G7+ countries have grown their oil products purchases from these refineries by 62% year-on-year.

Turkey expanded its dependence on Russian seaborne crude oil imports from around 34% in 2023 to 70% in the first half of 2024, taking advantage of a USD 5-20 per barrel discount for purchases of the Russian Urals crude blend.

The USA’s imports of oil products from Turkish refineries rose by more than three times year-on-year in H1 2024 and have generated EUR 125 mn in tax revenues for Russia.

The USA’s H1 2024 imports of oil products from the STAR refinery have generated EUR 38.3 mn in revenues for the US sanctioned company Lukoil — the single largest crude supplier to the refinery.

The USA’s H1 2024 Turkish imports of gasoline, estimated as being derived from Russian crude, could have fuelled an estimated 338,782 American vehicles every month in the same period.

The total volumes of crude oil processed by Turkish refineries to export oil products to EU and G7 countries have secured EUR 750 mn in tax revenues for the Kremlin in the first half of 2024 alone.

read more in our Telegram-channel https://t.me/The_International_Affairs

10:36 05.10.2024 •

10:36 05.10.2024 •