Sweden sees highest number of bankruptcy. In central Stockholm, Sweden.

Photo: Xinhua

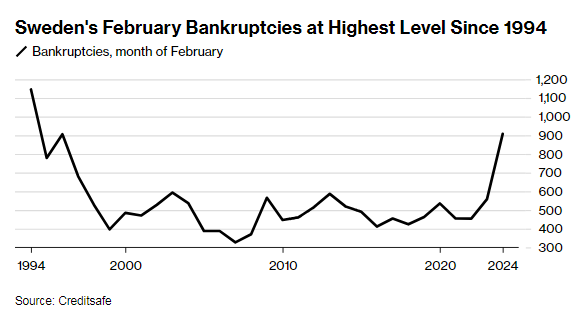

902 firms went bankrupt last month, according to Creditsafe. Restaurants and construction companies among those worst hit, Bloomberg informs.

Swedish bankruptcies rose in February to the highest level for that month in three decades, as housing construction has screeched to a halt and restaurants are facing lower demand amid rising prices and borrowing costs.

The number of defaults — which tends to fluctuate seasonally — rose by 62% from a year earlier to 902 last month, according to data compiled by credit reference company Creditsafe. The largest increase was recorded among hotels and restaurants, followed by consultancy firms and companies in the construction industry.

The data emerged after news that Sweden’s economy fared worse than expected in the final quarter of last year, upending a narrative that the biggest Nordic nation had escaped a short-lived recession. Seasonally adjusted gross domestic product shrank by 0.1% in the three months through December from the previous quarter.

The Nordic region’s largest country has seen its economy weaken following an 18-month long campaign of monetary policy tightening that has rapidly increased costs for mortgage borrowers who often have rates fixed on short terms. Combined with high inflation, that has weighed on consumer demand and led to a near standstill in housing construction.

The Swedish business sector is “right in the eye of the storm,” with 19 consecutive months of annual increases in the number of bankruptcies, Creditsafe’s Managing Director Henrik Jacobsson said in a statement. “In addition, we are seeing a large increase in the number of employees whose companies go bankrupt.”

The largest bankruptcy in February was car dealership Auto Lounge, with revenue of close to 500 million Swedish kronor ($48.2 million), followed by electric motorcycle startup Cake, whose estate has since been bought by a Norwegian investor.

read more in our Telegram-channel https://t.me/The_International_Affairs

10:28 05.03.2024 •

10:28 05.03.2024 •