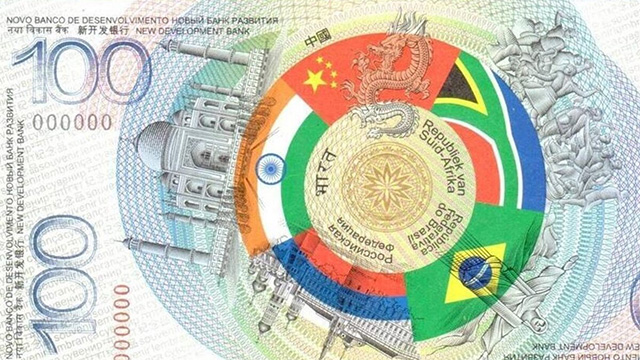

Now in their 15th year together, the original BRICS (Brazil, Russia, India, China and South Africa) meets. Mr Putin hopes to give the bloc heft by getting it to build a new global financial-payments system to attack America’s dominance of global finance and shield Russia and its pals from sanctions, writes Britain ‘The Economist’ in despair.

“Everyone understands that anyone may face us or other Western sanctions,” Sergei Lavrov, Russia’s foreign minister, said last month. A BRICS payments system would allow “economic operations without being dependent on those that decided to weaponise the dollar and the euro”. This system, which Russia calls “BRICS Bridge”, is intended to be built within a year and would allow countries to conduct cross-border settlement using digital platforms run by their central banks. Controversially, it may borrow concepts from a different project called mBridge that is part-run by a bastion of the Western-led order, the Bank for International Settlements (BIS).

The talks will shine a light on the race to remake the world’s financial plumbing. China has long bet that payments technology — not a creditors’ rebellion or military conflict — will reduce the power that America gets from being at the centre of global finance. The BRICS plan could deliver cheaper and faster transactions. Those benefits may be enough to entice emerging economies. In a sign the scheme has genuine potential, Western officials are wary that it may be designed to evade sanctions.

America’s dominance of the global financial system has been a mainstay of the post-war order. It reflects its economic and military heft, but also the fact that dollar-denominated assets such as Treasuries are seen as safe from government confiscation and inflation and are easy to buy and sell. Though central banks have diversified their holdings, including into gold, around 58% of foreign-currency reserves are in dollars and the network effects of the dollar put American banks at the centre of the world’s payments systems.

Because almost all banks transacting in dollars have to do so through a correspondent bank in America, it is able to monitor flows.

That provides America’s leaders with an enormous lever of power — one that they have been keen to pull as an alternative to going to war. The number of people under American sanctions has exploded by more than 900% (to around 9,400) in the two decades to 2021. America has demanded that some foreign banks are disconnected from swift, a Belgium-based messaging system used by some 11,000 banks in 200 countries to transfer funds across borders. In 2018 swift cut off Iran.

All this paled in comparison with the ferocity of the financial attack on Russia.

The West froze $282bn of Russian assets held abroad, disconnected Russian banks from SWIFT and prevented them from processing payments through America’s banks. America has also threatened “secondary sanctions” on banks in other countries that support Russia’s war effort. Even European policymakers, who support sanctions, were alarmed at how fast Visa and MasterCard — two American firms that the euro zone relies on for retail payments — closed shop in Russia. And the tsunami crashing over Russia has prompted America’s adversaries to accelerate their efforts to move away from the dollar, and pushed many other governments to look at their dependence on American finance. China views it as one of its biggest vulnerabilities.

Mr Putin is hoping to capitalise on this dollar dissatisfaction at the BRICS summit.

BRICS officials have held a flurry of meetings ahead of the summit in Kazan. They have discussed creating a credit-ratings Agency to rival the main Western ones, which Russia sees as “susceptible to politicisation”. They also examined creating a reinsurance firm to sidestep Western ones that are blocked from reinsuring some tankers transporting Russian oil, and a payments system to replace Visa and MasterCard.

By far the most serious initiative is a plan to use digital money backed by fiat currencies. This would place central banks, not correspondent banks with access to the dollar clearing system in America, in the middle of cross-border transactions. In decentralising the financial system, the proposal would mean that no one country could disconnect another.

Since commercial banks would transact through their own central banks, they would not need to maintain bilateral relationships with foreign banks, side-stepping the network effects of the current correspondent-banking system.

The efficiency gains of new kinds of digital money may erode the use of the dollar in cross-border trade, according to the Fed. Reciprocally they could boost China’s currency.

Speaking to bankers and officials about mBridge in September, a Hong Kong official said it “provides another opportunity to allow the easier use of the renminbi in cross-border payment, and Hong Kong as an offshore hub stands to benefit”.

Is it possible that mBridge’s concepts and code may be replicated by the brics, China or Russia? The bis doubtless views mBridge as a joint project and believes that it has the ultimate say over who can join.

The BRICS’s foray into the payments race reveals the new geopolitical challenges.

The world has become more difficult to navigate, acknowledges Cecilia Skingsley, the boss of the BIS Innovation Hub. But she says it still has a role to play in solving problems for all countries “almost independent of what other kind of agenda they might have”.

One option for America and its allies is to try to hobble new payment systems that compete with the dollar.

America is already gearing up to compete.

Any rival BRICS payments system will still face huge challenges. Guaranteeing liquidity will be difficult or require large implicit government subsidies.

Yet, for all that, the BRICS scheme may have momentum.

This week’s BRICS summit is no Bretton Woods. All that Russia and its pals have to do is move a relatively small number of sanctions-related transactions beyond America’s reach. Still, many are aiming higher.

Next year the BRICS summit will be held in Brazil, chaired by its president Luiz Inácio Lula da Silva, who fulminates over the power of the greenback. “Every night I ask myself why all countries have to base their trade on the dollar,” he said last year. “Who was it that decided?”

read more in our Telegram-channel https://t.me/The_International_Affairs

11:13 22.10.2024 •

11:13 22.10.2024 •