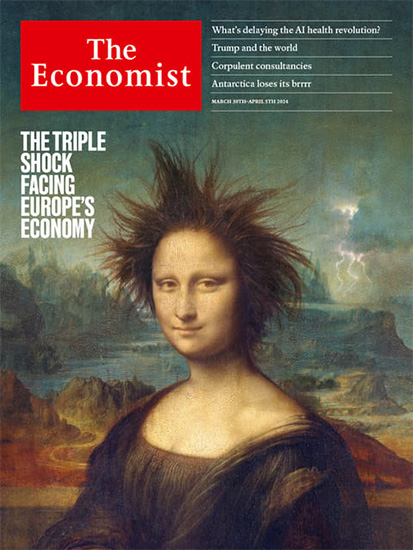

After the energy crisis, Europe faces surging Chinese imports and the threat of Trump tariffs, writes ‘The Economist’.

Europe is not known for its dynamism, but today it looks stagnant by any standard. Frazzled by the energy shock that followed Russia’s SMO of Ukraine in 2022, the European Union’s economy has grown by only 4% this decade, compared with 8% in America; since the end of 2022, neither it nor Britain has grown at all. If that were not bad enough, Europe faces a surge of cheap imports from China which, while benefiting consumers, could harm manufacturers and increase social and industrial strife. And within a year Donald Trump could be back in the White House, slapping huge tariffs on Europe’s exports.

The timing of Europe’s misfortune is bad. The continent needs strong growth in order to help fund more defence spending, especially since American support for Ukraine has dried up, and to meet its green-energy goals. Its voters are increasingly disillusioned and liable to back hard-right parties such as the Alternative for Germany. And long-standing drags on growth — a fast-ageing population, overbearing regulators and inadequate market integration — have not gone away.

There is a frenzy of activity in European capitals as governments try to respond. They must take care. Although the shocks facing Europe originate abroad, errors from Europe’s own policymakers could greatly aggravate the damage.

The good news is that the energy shock is past the moment of maximum pain: gas prices have fallen far from their peak. Unfortunately the others are just beginning. Faced with a deflationary slowdown, China’s government should be stimulating the country’s paltry household consumption, which could replace property investment as a source of demand. Instead President Xi Jinping is using subsidies to supercharge Chinese manufacturing, which already accounts for about a third of global goods production. He is relying on foreign consumers to prop up growth.

China’s focus is on green goods, most significantly electric vehicles, for which its global market share could double, to a third, by 2030. That would end the dominance of Europe’s national champions like Volkswagen and Stellantis (whose largest shareholder, Exor, part-owns The Economist’s parent company). From wind turbines to railway equipment, Europe’s manufacturers are nervously looking eastward.

After November manufacturers might look westward, too. Last time he was in office Mr Trump imposed tariffs on steel and aluminium imports, eventually including those from Europe, leading the eu to retaliate against motorbikes and whiskey until an uneasy truce was struck under President Joe Biden in 2021. Today Mr Trump threatens a 10% blanket tariff on all imports; his advisers talk of going further.

Another round of the trade war threatens Europe’s exporters, which had €500bn ($540bn) of sales in America in 2023. Mr Trump is obsessed with bilateral trade balances, meaning that the 20 (of 27) eu member states with a goods-trade surplus are natural targets. His team is also aggrieved by Europe’s digital levies, its carbon border tax and its value-added taxes.

What should Europe do? The path ahead is littered with traps.

…In conclusion, ‘The Economist’ gives some advice on how to get out of the crisis. This is about the future. But, today Europe continues to plunge into a swamp of economic problems.

read more in our Telegram-channel https://t.me/The_International_Affairs

9:02 30.03.2024 •

9:02 30.03.2024 •