The European Union has admitted it doesn’t have the power to deliver on a promise to invest $600 billion in the United States economy, only hours after making the pledge at landmark trade talks in Scotland, POLITICO writes.

That’s because the cash would come entirely from private sector investment over which Brussels has no authority, two EU officials said.

On Sunday, European Commission President Ursula von der Leyen struck a deal with U.S. President Donald Trump to avoid an all-out EU-U.S. trade war. The deal included a pledge to invest an extra $600 billion of EU money into the U.S. over the coming years.

But speaking Monday, two senior European Commission officials clarified that money would come exclusively from private European companies, with public investment contributing nothing.

“It is not something that the EU as a public authority can guarantee. It is something which is based on the intentions of the private companies,” said one of the senior Commission officials. The Commission has not said it will introduce any incentives to ensure the private sector meets that $600 billion target, nor given a precise timeframe for the investment.

The EU’s $600-billion promise played a key role in facilitating this agreement, but quickly drew criticism that an investment of that size would come at the cost of investment within Europe.

The Commission pointed out that the figure would come from private companies, not European taxpayers, contrasting with Japan’s promise to mobilize $550 billion of both public and private investments in the U.S. as part of a recently agreed trade deal.

But the idea that the private sector can be relied upon to provide that level of investment was met with skepticism.

"This part of the deal is largely performative," Nils Redeker from the Jacques Delors Centre think tank told POLITICO. "[The EU] is not China, right? So nobody can tell private companies how much they invest in the U.S."

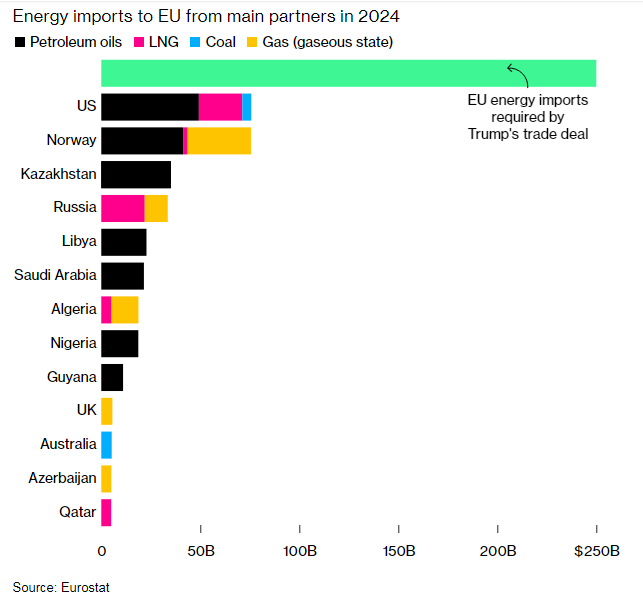

The European Union’s promise to buy $750 billion of American energy imports over three years was pivotal to securing a trade deal with President Donald Trump, but it’s a pledge it will struggle to keep, Bloomberg notes.

The deal would require annual purchases of $250 billion of natural gas, oil and nuclear technology, including small modular reactors, according to EU officials. European Commission President Ursula von der Leyen said the bloc’s estimates were based on the existing plan to shift away from remaining Russian fossil fuel supplies and purchasing “more affordable and better” liquefied natural gas from US producers.

Yet it’s hard to see how the EU attains such ambitious flows over such a short time frame. Total energy imports from the US accounted for less than $80 billion last year, far short of the promise made by von der Leyen to Trump. Total US energy exports were just over $330 billion in 2024.

The huge figure for energy imports “is meaningless, as it’s unachievable not only because EU demand cannot grow that much, but also because US exporters cannot supply that much either!” said Davide Oneglia, an economist at TS Lombard.

The lack of detail underlines that the deal finalized by von der Leyen and Trump in Scotland is a pragmatic, political agreement, rather than a legally binding pact.

The EU has yet to provide a breakdown of the figures, and it remains unclear how private companies can be convinced to purchase or sell US oil and gas. There’s also uncertainty around how European investment in the US energy sector might count toward the EU’s pledge.

“We believe these numbers are achievable,” Maros Sefcovic, EU trade commissioner, said at a press conference in Brussels, where he also highlighted the “nuclear renaissance” taking place in Europe. “That’s the offer. We are ready to go for those purchases.”

Europe has become a major buyer of US barrels since the region began dialing back its purchases from Russia after the invasion of Ukraine. At times, flows from the US Gulf to the continent have reached more than 2 million barrels a day, about half of total American crude export volumes.

Any further increase in purchases could prove problematic for the region’s oil refineries which need a mix of supplies to make a enough of the right kind refined fuels like gasoline and diesel.

In the first half of 2025, EU countries imported about 1.53 million barrels a day of oil from the US, of which 86% was in the form of crude, according to data from analytics firm Kpler. Those imports were worth about $19 billion.

That represented about 14% of total EU oil consumption, which averaged 10.66 million barrels a day last year, according to data from the Energy Institute Statistical Review of World Energy.

read more in our Telegram-channel https://t.me/The_International_Affairs

11:23 30.07.2025 •

11:23 30.07.2025 •