A statue which was displayed at the United Nations in New York, likened to the end-times "beast" from the New Testament's book of Revelation.

The world is today confronted with two nuclear threats of a proportion never previously seen in history. These threats are facing us at a time when the world economy is about to turn and decline precipitously not just for years but probably decades, writes in his in a detailed commentary Swiss financial analyst Egon von Greyerz, Founder and Managing Partner “Matterhorn Asset Management”.

The obvious nuclear threat is the war between the US and Russia which currently is playing out in Ukraine.

The other nuclear threat is the financial weapons of mass destruction in the form of debt and derivatives amounting to probably US$ 2.5 quadrillion.

If we are lucky, the geopolitical event can be avoided but I doubt that the explosion/implosion of the Western financial timebomb can be stopped.

In my estimation this is not a war between Russia and Ukraine but between the US and Russia. Russia found it unacceptable that the Minsk agreement of 2014 was not kept to. Instead, the bombing of the Donbas area continued, allegedly encouraged by the US. As Ukraine intensified the bombing, Russia invaded in Feb 2022.

I won’t go into the details here of who is at fault etc. But what is clear is that the US Neocons have a major interest for this war to escalate. For them Ukraine is just a pawn and the real enemy is Russia.

Most of Europe is heavily dependent on Russian oil and gas. Still Europe is shooting itself in the foot by agreeing to the sanctions initiated by the US. The consequences are disastrous for Europe and especially Germany which was the economic engine of Europe. Germany is now finished as an economic power. Time will prove this.

The global economic downturn started before the Ukrainian war but the situation has now severely deteriorated with the European economy weakening rapidly. Still, Europe is digging its own grave by sending more weapons and more money to Ukraine much of which being reported to end up in the wrong hands.

The Ukrainian leader Zelensky is skilfully inciting the West to escalate the war in order to achieve total NATO involvement.

The risk of a major escalation of the war is considerable. The US Neocons want to weaken Russia in a direct conflict. Major wars are often triggered by a minor event or a false flag.

The Neocons know that a defeat for the US in this conflict would be the end of the US dollar, hegemony and economy. At the same time, Russia is determined not to lose the war, whatever it takes. This is the kind of background that has a high risk of ending badly.

Since there is not a single Statesman in the West, dark forces behind the scenes are pulling the strings. This makes the situation particularly dangerous.

The risk of a nuclear war in such a situation is incalculable but still very real. There are 13,000 nuclear warheads in the world and less than a handful of these would wipe out most of the West and a dozen, a major part of the world.

Let’s hope that the West comes to its senses. If not, the consequences are unthinkable.

The other nuclear cloud which is financial will fortunately not end the world if it detonates but inflict a major global setback that could last many years, maybe decades.

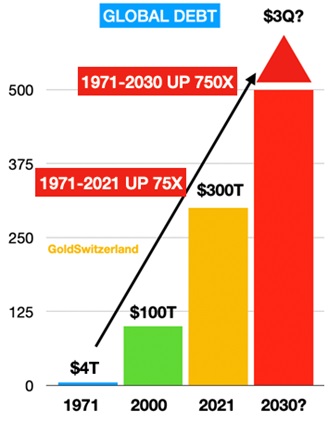

The global debt expansion will end badly. This can be illustrated in a number of facts and graphs.

This one shows how global debt has grown 75X from $4 trillion to $300T since Nixon closed the gold window in 1971.

The graph also shows that the world could reach debt levels of maybe $3 quadrillion by 2030.

The US, the world’s biggest economy, is living on both borrowed time and money. In 1970 total US debt was 1.5X GDP. Today is is 3.6X. This means that in order to achieve a nominal growth in GDP, debt had to grow 2.5X as fast as GDP.

The conclusion is simple. Without credit and printed money there would be no real GDP growth. So the growth of the US economy is an illusion manufactured by bankers and led by the private Federal Reserve Bank. GDP can only grow if debt grows at an exponential rate.

The gap between debt and GDP growth is clearly unsustainable. Still with hysterical money printing in the next few years, in an attempt to save the US financial system, the gap is likely to widen even further before it is eroded.

There is only one way for the gap to narrow which is an implosion of the debt through default, both sovereign and private. Such an implosion will also lead to all assets inflated by the debt – including bonds, stocks and property – also imploding.

Temporarily the US has achieved this illusory wealth but sadly the time is now coming when the Piper must be paid.

The days of the dollar as reserve currency are counted. A currency that has lost 98% in the last 50 years hardly deserves the status of a reserve currency.

A combination of military might, petrodollar payments and history has kept the dollar far too strong for much too long. Since there is no immediate alternative, it is possible that the dollar temporarily will remain strong for a while as the Ukrainian conflict continues.

The days of the Petrodollar are also counted. Major moves are now taking place between the world’s biggest energy producers (excluding the US) which will gradually end the Petrodollar system.

But firstly let’s understand that in spite of the climate zealots, there will be no serious alternative to fossil fuels for many decades. Fossil fuels account for 83% of global energy.

Global growth can only be achieved with energy. Since renewables today only account for 6% and are growing very slowly, there will be no serious alternative to fossil fuels for many decades.

In spite of that, Western governments in Europe and the US have not only stopped investing in fossil fuels, but also closed down pipe lines, coal mines and nuclear power plants. This is of course sheer political and economic lunacy and a very rapid method to achieve a collapse of the world economy.

The GCC countries (Gulf Corporation Council) consist of Saudi Arabia, UAE plus a number of Gulf countries have 40% of the oil reserves in the world.

Another 40% of oil reserves belong to Russia, Iran and Venezuela all selling oil to China at a discount currently.

In addition there are the BRICS countries (Brazil, Russia, India, China and South Africa. Saudi Arabia also want to join the BRICS which represents 41% of the global population and 26% of global GDP.

Finally there is the SCO, the Shanghai Cooperation Organisation. This is a Eurasian political, economic and security organisation headquartered in China. It covers 60% of the area of Eurasia and over 30% of global GDP.

All of these organisations and countries (BRICS, GCC, SCO) are gradually going to gain global importance as the US, and Europe decline. They will cooperate both politically, commercially and financially.

As energy and oil is a common denominator for these countries, they will most likely operate with the Petroyuan as their common currency for trading.

With such a powerful constellation, minor hobbyist groups like Schwab’s World Economic Forum will dwarf in significance and finally disappear as the WEF members including the political leaders lose their power and the billionaires their wealth.

A full nuclear war between the US, Russia and China is the end of mankind and no one can protect against this kind of event.

To summarise, the risks today are greater than anytime in history, warns the Swiss financial analyst Egon von Greyerz.

read more in our Telegram-channel https://t.me/The_International_Affairs

11:51 12.01.2023 •

11:51 12.01.2023 •