A Trump aide shows a chart of new tariffs the US is imposing on trade with virtually the entire world.

A Trump aide shows a chart of new tariffs the US is imposing on trade with virtually the entire world.

Photo: AP

Trump’s protectionist policies and general volatility could transform the nature of the EU-US relationship, accelerate multipolarisation, and end the hegemony of the US dollar, ‘Euractiv’ writes.

Trump’s sweeping “reciprocal tariffs” are definitely bad news for Europe – but they’re potentially devastating for the United States.

The US president’s decision on Wednesday to impose blanket 20% tariffs on EU goods – as well as a minimum 10% levy on all other imports – will reduce eurozone GDP this year by much less than it will US output, according to several studies released on Thursday.

Moreover, Trump’s protectionist policies and general volatility could prompt radical changes in the global economy that might transform the nature of the EU-US relationship, accelerate multipolarisation, and end the hegemony of the US dollar, analysts said.

Thursday’s announcement represents a “massive regime shift” that potentially “spells the end of the American century”, said Sony Kapoor, a professor of geoeconomics at the European University Institute.

“Any sensible, half-prudent company, person, country, or bloc should be thinking of hedging their bets and diversifying their ties across economic, financial, and security dimensions” away from the United States, he said.

In a nod to these future efforts, European Commission President Ursula von der Leyen said on Thursday that the EU will seek to "build bridges" with other nations that "care about fair and rules-based trade".

The remarks came as Deutsche Bank (Trump's longtime lender) on Thursday cut its growth forecast for the euro area this year from 0.8% to 0.25-0.50%, while slashing its expected US growth figure from 2.2% to 1%.

The Conference Board, a US-based think tank, similarly estimated that Trump’s policies could reduce the EU’s GDP by 0.2 percentage points this year, well below the hit to US GDP of 1.2 percentage points.

Echoing these assessments, Kapoor said the new duties would likely be “bad but not life-threatening” for the European economy.

The tariffs increase the risk of a eurozone recession primarily because the bloc is already suffering from a litany of challenges including high energy prices, weak demand, and fierce competition from Chinese exporters, he said.

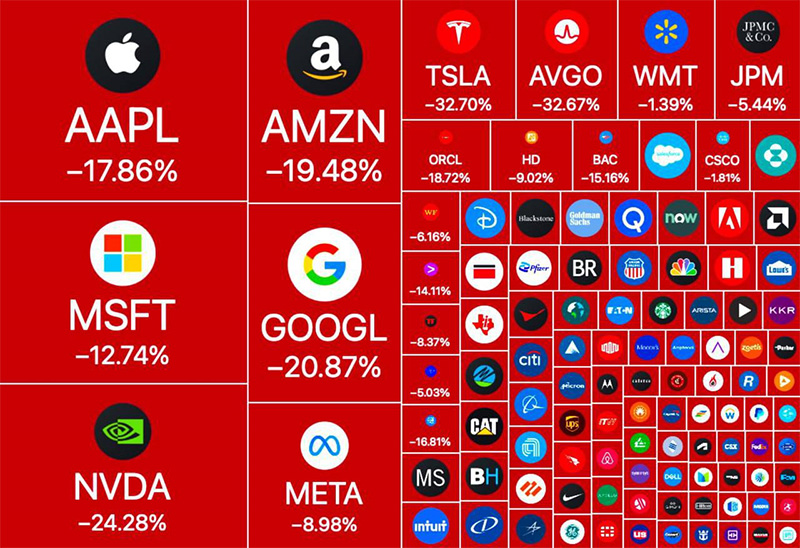

The divergent fortunes of the US and EU were also reflected in stock market movements on Thursday.

The S&P 500, which tracks leading US firms, was down 4.10% as of 9pm CET, while the STOXX Europe 600, a broad measure of European equities, had fallen just 2.57%. The S&P has slid 7.33% since the start of this year while the STOXX has risen 2.44%.

Trump’s policies could also lead to a fundamental shift in the nature of the EU-US relationship, analysts said.

Since returning to the White House in January, Trump has repeatedly condemned the EU’s “absolutely brutal” trade surplus in goods with the US, questioned Washington’s commitment to European security, and threatened to annex Greenland, the mineral-rich Arctic island controlled by Denmark.

The tariffs’ impact on the EU-China ties, however, is much less clear-cut.

Some analysts agreed with von der Leyen’s warning on Thursday that the new US duties could lead to China “dumping” billions of euros’ worth of goods onto the EU market.

China’s global trade surplus hit a record $1 trillion last year, driven in large part by massive state subsidisation of manufacturers of green technologies including solar panels, electric vehicles, batteries, and wind turbines.

The EU's trade deficit in goods with Beijing also rose from €291 billion to €304.5 billion from 2023 to 2024.

“I'm very concerned about China's huge trade surplus in manufactured goods now bouncing off the US and being rerouted to the large remaining market that's open, which is Europe,” said Sander Tordoir, chief economist at the Centre for European Reform.

However, Tordoir noted that future Chinese dumping – coupled with a potential “massive” devaluation of the renminbi and weak European demand – suggest that “disinflationary pressures are going to outweigh the inflationary pressures” in future.

His analysis was echoed by Carsten Brzeski, head of macro at ING Research, who noted that China and other countries could seek to cut prices to boost exports to Europe.

“As counterintuitive as it might sound, in the longer run, a fully fledged trade war is likely to be disinflationary for Europe,” Brzeski said.

Analysts also said that investors’ concerns over Trump’s policies and general unpredictability could cause the dollar to lose its status as the global reserve currency, which has allowed the US to borrow at exceedingly low rates since the end of the Second World War.

Underscoring these fears, the dollar has fallen 5.93% against a basket of other currencies since the start of this year. The euro also rose 1.23% against the dollar on Thursday to reach $1.10 as of 9pm CET.

Tariffs the Trump administration announced on US trading partners would likely push the US and possibly the global economy into a recession in 2025 if they remain in place, according to JPMorgan’s top economist, Bloomberg quotes.

“The risk of recession in the global economy this year is raised to 60%, up from 40%,” JPMorgan Chief Economist Bruce Kasman said Thursday in a note to clients, calling the tariffs the largest tax hike on US households and businesses since 1968.

“The effect of this tax hike is likely to be magnified — through retaliation, a slide in US business sentiment, and supply chain disruptions,” Kasman said in the note titled, “There will be blood.”

Several Wall Street firms on Thursday warned of a US recession, with some making it their base case, after President Donald Trump announced major levies on goods imported from countries around the world. Other economists, including those at JPMorgan, said the hit could be big, though they are taking a wait-and-see approach before revising their projections.

The announcement rocked global financial markets, and the S&P 500 suffered its worst day since 2020. Trump, speaking on Air Force One on Thursday afternoon, said he was open to reducing tariffs if trading partners were able to offer something “phenomenal.”

“We are not making immediate changes to our forecasts and want to see the initial implementation and negotiation process that takes hold,” Kasman said in the note.

“However, we view the full implementation of announced policies as a substantial macroeconomic shock not currently incorporated in our forecasts,” he said. “We thus emphasize that these policies, if sustained, would likely push the US and possibly global economy into recession this year.”

read more in our Telegram-channel https://t.me/The_International_Affairs

10:23 05.04.2025 •

10:23 05.04.2025 •