It is hard to be a safe haven when trouble starts at home, ‘The Economist’ stresses.

The Federal Reserve and the Treasury Department are the stewards of the dollar at home and abroad. Kevin Warsh, President Donald Trump’s pick to lead the Fed, will become one of the currency’s most senior custodians if he is confirmed by the Senate to succeed Jerome Powell in May. Foreign-exchange markets have already reacted to the news of his possible appointment: despite his recent doveish talk, Mr Warsh’s earlier advocacy for higher interest rates helped arrest the slide of the dollar, which has declined in value by about 10% since the beginning of 2025.

The strength of the dollar and America’s international credibility are not one and the same. But they are linked, and perhaps increasingly so, by the appeal of America as an investment destination. Mr Warsh will inherit a climate of nervousness overseas about dollar-denominated assets, whipped up by American belligerence towards its allies and Mr Trump’s upturning of decades of trade liberalisation. In the 15 years since Mr Warsh last served on the Fed’s board, the structure of foreign-owned investments in America has shifted dramatically. Investors have piled into risky assets, leaving the greenback more vulnerable to a spate of weakness driven by American underperformance and slapdash policymaking in Washington.

Today reserve assets are on the lowest level in modern history

The declining weight of dollar-denominated assets in foreign-exchange reserves held by central banks around the world has often been cited as evidence that the currency’s global role is dwindling. That share has dropped from a high of 72% in 1999 to 57% today.

Seventeen years ago debt securities held by foreign governments and central banks accounted for about 38% of all portfolio investment into America and politicians fretted about the $1trn and more in Treasury bonds owned by Chinese institutions. Today reserve assets and other sovereign holdings of American debt securities amount to just 13% of the value of American portfolio holdings, the lowest level in modern history.

International buyers of American assets during Mr Powell’s tenure have been motivated by profits rather than protection. In less than two decades the share of foreign-owned American assets accounted for by American stocks has almost tripled, rising from a low of 21% in the aftermath of the global financial crisis of 2007-09 to a record 58% today.

Many large governments in the developing world have adopted healthier macroeconomic policies and fostered domestic bond markets, allowing investors to swap some American securities for local debt. At the same time, American companies have proved to be innovative and vastly profitable, drawing legions of foreign investors to their shares.

The American government itself is driving the turmoil

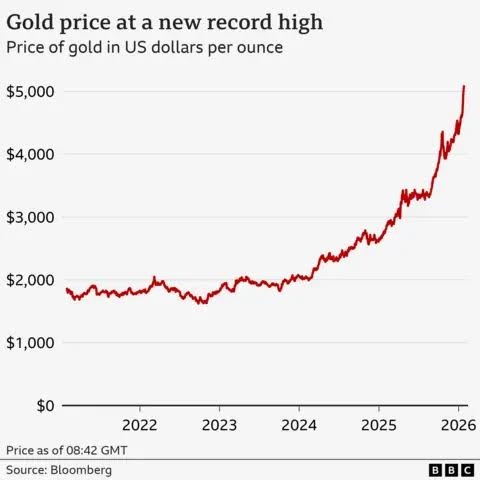

But riskier assets are deemed so for a reason. Last year, as Mr Trump’s tariffs and fears of an artificial-intelligence bubble started to erode trust in American stocks, their total return fell below that of their global peers by five percentage points, the largest margin since 2009. The Magnificent 7—a bundle of gargantuan technology stocks that have led the American market for years—have largely flatlined for the past four months. Software stocks have tumbled and emerging-market equities are on a roll. Investors are beginning to take the prospect of a longer period of American underperformance more seriously than they have in years.

They are no longer seeking refuge where they used to. For decades investors have piled into Treasuries when markets are distressed, earning them the status of “safe haven”. But in April, after Mr Trump announced his wall of tariffs, long-term Treasury yields rose even as stocks sold off. The same happened again in both October and January, during tariff-related wobbles. It is hard for Treasuries to be safe havens when the American government itself is driving the turmoil. In the language of a horror movie, the call is coming from inside the house.

If large, patient investors turn their supertankers away from America, the greenback could come under irresistible pressure. The real danger for the dollar is American equities falling out of favour, says Aaron Costello of Cambridge Associates, an investment firm. “The geopolitics just adds fuel to the fire.” Soaring asset prices, flows into equity markets and a rising dollar have reinforced one another in recent years.

It will come out in the Warsh

The growing view among investors is that Mr Warsh’s ascent at the Fed portends more uncertainty about the dollar. He is an instinctive hawk who has adopted a doveish approach of late to match the president’s credo. He is preoccupied with shrinking the Fed’s balance-sheet and is a far more political animal than many of his predecessors. His relationship with Mr Trump, and how much more the president gets his way on monetary policy as a result, will only become clear over time.

No rival asset looks ready to supplant the dollar as the world’s reserve currency. But demand for greenbacks can ebb meaningfully without any serious challenger emerging. The ongoing erosion of America’s safe-haven status, together with uncertainty over the policy and independence of its central bank, mean the dollar’s appeal increasingly rests on the ability of American assets to outperform those in the rest of the world.

As Mr Warsh prepares to lead the world’s most important central bank, the dollar looks more vulnerable than at any time in recent history.

read more in our Telegram-channel https://t.me/The_International_Affairs

11:53 11.02.2026 •

11:53 11.02.2026 •