The average EU country poorer per head than every U.S. state except Idaho and Mississippi, according to a report this month by the ‘European Centre for International Political Economy’, a Brussels-based independent think tank.

If the current trend continues, by 2035 the gap between economic output per capita in the U.S. and EU will be as large as that between Japan and Ecuador today, the report said.

‘Yes, we’re all worse off,’ Europeans complain. An aging population that values its free time set the stage for economic stagnation. Then came Covid-19 and Russia’s war in Ukraine, ‘Wall Street Journal’ writes with some malice.

Europeans are facing a new economic reality, one they haven’t experienced in decades. They are becoming poorer.

Life on a continent long envied by outsiders for its art de vivre is rapidly losing its shine as Europeans see their purchasing power melt away.

The French are eating less foie gras and drinking less red wine.

Spaniards are stinting on olive oil. Finns are being urged to use saunas on windy days when energy is less expensive.

Across Germany, meat and milk consumption has fallen to the lowest level in three decades and the once-booming market for organic food has tanked.

Italy’s economic development minister, Adolfo Urso, convened a crisis meeting in May over prices for pasta, the country’s favorite staple, after they jumped by more than double the national inflation rate.

With consumption spending in free fall, Europe tipped into recession at the start of the year, reinforcing a sense of relative economic, political and military decline that kicked in at the start of the century.

Europe’s current predicament has been long in the making. An aging population with a preference for free time and job security over earnings ushered in years of lackluster economic and productivity growth. Then came the one-two punch of the Covid-19 pandemic and Russia’s protracted war in Ukraine. By upending global supply chains and sending the prices of energy and food rocketing, the crises aggravated ailments that had been festering for decades.

Governments’ responses only compounded the problem. To preserve jobs, they steered their subsidies primarily to employers, leaving consumers without a cash cushion when the price shock came.

In the past, the continent’s formidable export industry might have come to the rescue. But a sluggish recovery in China, a critical market for Europe, is undermining that growth pillar. High energy costs and rampant inflation at a level not seen since the 1970s are dulling manufacturers’ price advantage in international markets and smashing the continent’s once-harmonious labor relations. As global trade cools, Europe’s heavy reliance on exports — which account for about 50% of eurozone GDP versus 10% for the U.S. — is becoming a weakness.

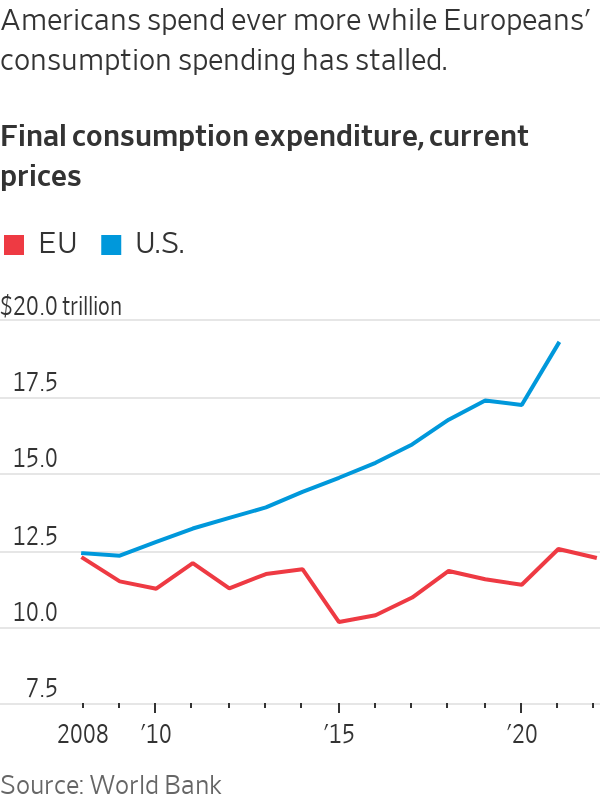

Private consumption has declined by about 1% in the 20-nation eurozone since the end of 2019 after adjusting for inflation, according to the Organization for Economic Cooperation and Development, a Paris-based club of mainly wealthy countries. In the U.S., where households enjoy a strong labor market and rising incomes, it has increased by nearly 9%.

The European Union now accounts for about 18% of all global consumption spending, compared with 28% for America. Fifteen years ago, the EU and the U.S. each represented about a quarter of that total.

Adjusted for inflation and purchasing power, wages have declined by about 3% since 2019 in Germany, by 3.5% in Italy and Spain and by 6% in Greece.

The pain reaches far into the middle classes. In Brussels, one of Europe’s richest cities, teachers and nurses stood in line on a recent evening to collect half-price groceries from the back of a truck.

The vendor, Happy Hours Market, collects food close to its expiration date from supermarkets and advertises it through an app. Customers can order in the early afternoon and collect their cut-price groceries in the evening. “Some customers tell me, because of you I can eat meat two or three times per week,” said Pierre van Hede, who was handing out crates of groceries.

Spending on high-end groceries has collapsed. Germans consumed 52 kilograms of meat per person in 2022, about 8% less than the previous year and the lowest level since calculations began in 1989. While some of that reflects societal concerns about healthy eating and animal welfare, experts say the trend has been accelerated by meat prices which increased by up to 30% in recent months. Germans are also swapping meats such as beef and veal for less-expensive ones such as poultry, according to the Federal Information Center for Agriculture.

Weak spending and poor demographic prospects are making Europe less attractive for businesses ranging from consumer-goods giant Procter & Gamble to luxury empire LVMH, which are making an ever-larger share of their sales in North America.

“The U.S. consumer is more resilient than in Europe,” Unilever’s chief financial officer, Graeme Pitkethly, said in April.

The eurozone economy grew about 6% over the past 15 years, measured in dollars, compared with 82% for the U.S., according to International Monetary Fund data.

That has left the average EU country poorer per head than every U.S. state except Idaho and Mississippi, according to a report this month by the European Centre for International Political Economy, a Brussels-based independent think tank.

If the current trend continues, by 2035 the gap between economic output per capita in the U.S. and EU will be as large as that between Japan and Ecuador today, the report said.

Weak growth and rising interest rates are straining Europe’s generous welfare states, which provide popular healthcare services and pensions. European governments find the old recipes for fixing the problem are either becoming unaffordable or have stopped working. Three-quarters of a trillion euros in subsidies, tax breaks and other forms of relief have gone to consumers and businesses to offset higher energy costs — something economists say is now itself fueling inflation, defeating the subsidies’ purpose.

Public-spending cuts after the global financial crisis starved Europe’s state-funded healthcare systems, especially the U.K.’s National Health Service.

Huw Pill, the Bank of England’s chief economist, warned U.K. citizens in April that they need to accept that they are poorer and stop pushing for higher wages. “Yes, we’re all worse off,” he said, saying that seeking to offset rising prices with higher wages would only fuel more inflation.

With European governments needing to increase defense spending and given rising borrowing costs, economists expect taxes to increase, adding pressure on consumers. Taxes in Europe are already high relative to those in other wealthy countries, equivalent to around 40-45% of GDP compared with 27% in the U.S.

The pauperization of Europe has bolstered the ranks of labor unions, which are picking up tens of thousands of members across the continent, reversing a decadeslong decline, stresses WSJ.

read more in our Telegram-channel https://t.me/The_International_Affairs

10:47 23.07.2023 •

10:47 23.07.2023 •