The UK is expected to see an unprecedented net loss of 9,500 millionaires in 2024 — second only to China worldwide, and more than double the 4,200 who left the country last year, which was itself record-breaking following the exodus of 1,600 high-net-worth individuals (HNWIs) in 2022. These are the point of a Henley & Partners ‘Private Wealth Migration Report 2024’.

Henley & Partners is the global leader in residence and citizenship by investment. Each year, hundreds of wealthy individuals and their advisors rely on our expertise and experience in this area. The firm’s highly qualified professionals work together as one team in over 55 offices worldwide.

For the third year running, the UAE looks set to take first place as the world’s leading wealth magnet, with a record-breaking 6,700 moneyed migrants expected to make the Emirates home by the end of the year, significantly boosted by large inflows from the UK and Europe.

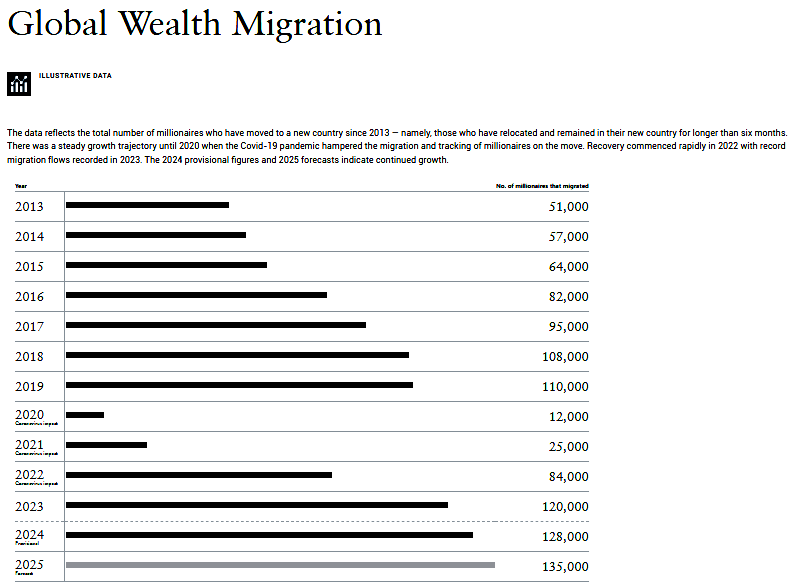

Dominic Volek, Group Head of Private Clients at Henley & Partners, says 2024 is shaping up to be a watershed moment in the global migration of wealth. “An unprecedented 128,000 millionaires are expected to relocate worldwide this year, eclipsing the previous record of 120,000 set in 2023. As the world grapples with a perfect storm of geopolitical tensions, economic uncertainty, and social upheaval, millionaires are voting with their feet in record numbers. In many respects, this great millionaire migration is a leading indicator, signaling a profound shift in the global landscape and the tectonic plates of wealth and power, with far-reaching implications for the future trajectory of the nations they leave behind or those which they make their new home.”

UAE remains world’s leading millionaire magnet. With its zero income tax, golden visas, luxury lifestyle, and strategic location, the UAE has entrenched itself as the world’s number one destination for migrating millionaires and is poised to welcome a record net inflow of 6,700 this year alone. With consistent high inflows from India, the wider Middle East region, Russia, and Africa, the anticipated influx of larger numbers of Brits and Europeans looks set to see the Emirates attract nearly twice as many millionaires as its nearest rival, the US, which is projected to benefit from a net inflow of 3,800 millionaires in 2024.

As Sunita Singh-Dalal, Partner leading the Private Wealth & Family Offices at Hourani in Dubai points out in the report, “the evolution and development of the UAE’s wealth management ecosystem is unprecedented. In less than 5 years, the UAE has introduced a robust regulatory framework that provides the wealthy with a range of innovative solutions to protect, preserve and enhance their wealth.”

Singapore takes 3rd prize again this year with net inflows of 3,500, while the perennially popular destinations for migrating millionaires, Canada and Australia, follow in 4th and 5th places with net inflows of 3,200 and 2,500, respectively. European favorites Italy (+2,200), Switzerland (+1,500), Greece (+1,200) and Portugal (+800) all make it into this year’s Top 10 for net millionaire inflows along with Japan, which is on course to welcome 400 wealthy migrants, boosted in part by an accelerating trend of Chinese HNWIs moving to Tokyo that started post-Covid.

The report also reveals that Israel has dropped out of the top inflows list for the first time. This represents a major turnabout as Israel has been ranked among the Top 10 destinations for migrating millionaires for several decades. Dan Marconi, Senior Client Advisor at Henley & Partners Israel says, “this seismic shift underscores how swiftly conflict can unravel a country’s appeal to the world’s wealthy and globally mobile. The ongoing war has not only shattered Israel’s image as a safe haven but also threatened to overshadow its economic achievement.”

Britain pulls the plug on millionaires. The UK, and London especially, has traditionally been seen as one of the world’s top destinations for migrating millionaires and for many years (from the 1950s to early 2000s) it consistently attracted large numbers of wealthy families from mainland Europe, Africa, Asia, and the Middle East. However, this trend began to reverse around a decade ago as more millionaires began to leave the country and fewer came in. Notably, during the six-year period from 2017 to 2023 post Brexit, the UK lost a total of 16,500 millionaires to migration. Provisional estimates for 2024 are even more concerning, with a massive net outflow of 9,500 millionaires projected for this year alone. Is Britain for the poor?

Photo: wales247.co.uk

Photo: wales247.co.uk

Commenting in the Henley Private Wealth Migration Report 2024, Dr. Hannah White OBE, Director and CEO of the independent think tank the Institute for Government in London, says “the outflow already generated by the economic and political turmoil in Britain risks being accelerated by further unwelcome policy decisions ahead of the election. On top of the 40% duty already imposed on estates above a GBP 325,000 threshold, the Conservative government has adopted the thrust of the Labour opposition’s policy of ending the UK’s non-dom tax regime from 2025. And for those educating their children in the UK’s well-regarded private school sector, Labour’s commitment to remove their exemption from 20% VAT is a further unwelcome development.”

Spear’s Contributing Editor Alec Marsh agrees, saying “even before the starting gun was fired on July 4’s general election, it’s apparent that the wealthy in Britain are already voting with their feet.

According to the W15 ranking of the world’s top 15 countries for millionaires published in the report, the number of millionaires in the UK has dropped by 8% over the past decade — while soaring elsewhere. In Germany, the HNWI population has increased by 15% over the last 10 years, in France it’s up 14%, while the number has risen by 35% in Australia, 29% in Canada, and an astonishing 62% in the USA.

read more in our Telegram-channel https://t.me/The_International_Affairs

11:34 25.06.2024 •

11:34 25.06.2024 •