UK factory revival prospects suffer setback in December

Car production at the Morgan Motor Company factory in Malvern.

Car production at the Morgan Motor Company factory in Malvern.

Photo: Reuters

Britain's manufacturing sector suffered a setback in its attempts to return to growth as output and employment fell more sharply in December than the previous month, according to a published survey.

The final reading of the S&P Global/CIPS manufacturing Purchasing Managers' Index (PMI) weakened to 46.2 in December, ending a run of three months of improvement and down from a seven-month high of 47.2 in November.

The reading was also down slightly from a preliminary December estimate of 46.4 and was below the 50.0 growth threshold for a 17th month in a row.

Britain's manufacturing sector has borne the brunt of the climb in borrowing costs. By contrast, preliminary PMIs for December showed the country's much bigger services sector saw the strongest growth in six months.

Rob Dobson, director at S&P Global Market Intelligence, said the fall in new orders for manufacturers was seen in the domestic and export markets, particularly in the European Union, and confidence in the sector was at its lowest in a year.

Cutbacks to stock levels, purchasing and employment reflected a cautious approach to costs, he said.

"With concerns about high interest rates and the cost-of-living crisis hurting demand, the outlook for manufacturers in the months ahead remains decidedly gloomy," Dobson said.

"The downturn in demand is having some positive effects on supply chains, however, with suppliers reducing their prices for raw materials and vendor lead times showing a further improvement."

Manufacturers increased their prices marginally for a second month in a row, driven by the investment goods sector. The fall in input costs was the smallest since May.

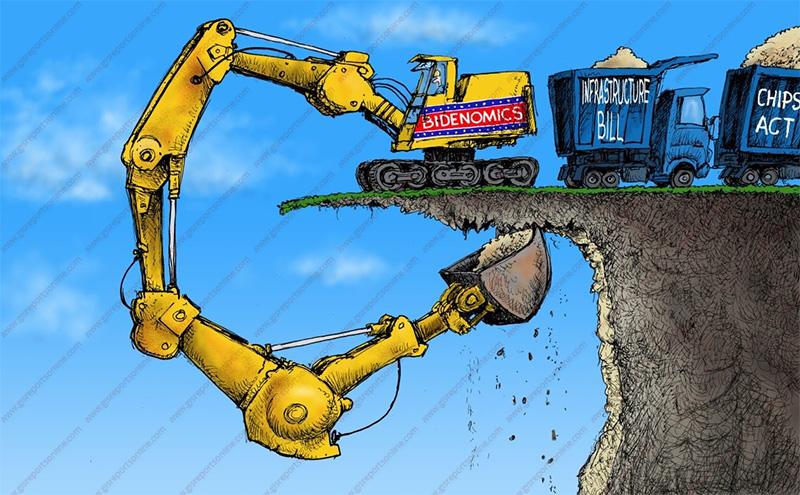

Does ‘Bidenomics’ work?

President Biden’s attempt to sell Americans on his role in post-pandemic economic recovery has fallen flat, even as the U.S. economy defies the odds and expectations of experts, writes ‘The Hill’.

Despite widespread fears at the beginning of the year that a recession was on the way, the U.S. economy is on track to finish 2023 with low unemployment, steady economic growth and significantly slower inflation.

These remarkable topline numbers, however, have done little to help Biden’s standing with voters or their views on the economy.

“You don’t expect sentiment and economic fundamentals to always track perfectly, but they are really, really off,” said Matt Darling, senior employment policy analyst at the Niskanen Center, a nonprofit think tank.

But experts warn that touting strong economic data in the face of growing frustration with the economy risks backfiring on Biden and deepening the backlash.

“People’s individual experiences in the economy should not be considered incorrect just because they’re at odds with macroeconomic statistics,” said Kathryn Ann Edwards, an independent economic policy consultant.

“The economy is doing well, and people don’t feel like they’re doing well. Well, put a name to that: It’s being left behind and it’s being told over and over again, ‘You’re being left behind.’”

Most economic experts pin much of the frustration on the stubbornness of high inflation. While inflation has eased, it is still well above the Fed’s 2 percent annual target. Many Americans have also been feeling the frustration of rising prices for years.

“People can understand over time that houses go up in value, cars go up in value,” said Gordon Gray, vice president for economic policy at the American Action Forum, a right-leaning research nonprofit.

“But at the end of the day, with eggs and gasoline, people kind of want to pay what they have always paid — or at least close to it.”

“Inflation allows a lot of people to name frustrations that come from a lot of sources. And we’ve known for a while that there are there are lots of people who have almost no financial cushion,” Edwards said.

read more in our Telegram-channel https://t.me/The_International_Affairs

8:59 10.01.2024 •

8:59 10.01.2024 •