Pic.: gregorywald.com

Corporate bankruptcies surged in 2025, rivaling levels not seen since the immediate aftermath of the Great Recession, as import-dependent businesses absorbed the highest tariffs in decades, ‘The Washington Post’ writes.

At least 717 companies filed for bankruptcy through November, according to data from S&P Global Market Intelligence. That’s roughly 14 percent more than the same 11 months of 2024, and the highest tally since 2010.

Companies cited inflation and interest rates among the factors contributing to their financial challenges, as well as Trump administration trade policies that have disrupted supply chains and pushed up costs.

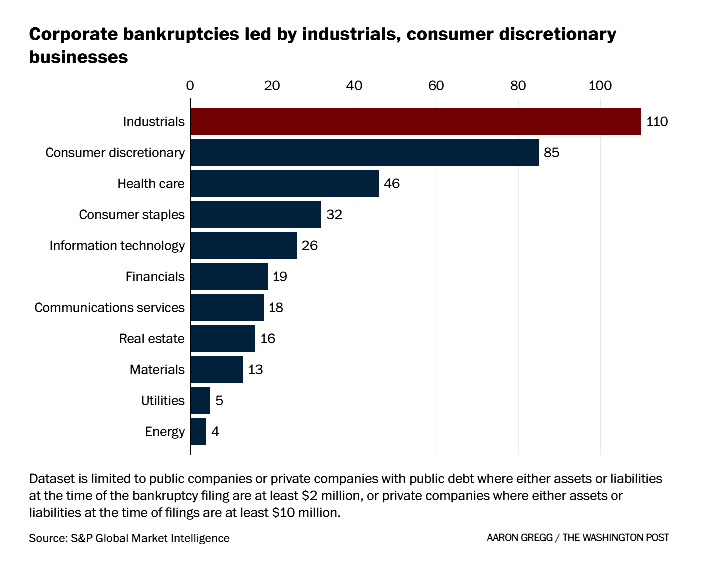

But in a shift from previous years, the rise in filings is most apparent among industrials — companies tied to manufacturing, construction and transportation. The sector has been hit hard by President Donald Trump’s ever-fluid tariff policies — which he’s long insisted would revive American manufacturing. The manufacturing sector lost more than 70,000 jobs in the one-year period ending in November, federal data shows.

Consumer-oriented businesses with “discretionary” products or services, such as fashion or home furnishings, represented the second-largest group. This contingent usually tops the list and includes many retailers, and its retrenchment is a signal that inflation-weary consumers are prioritizing essentials.

The S&P data reflects both Chapter 11 and Chapter 7 filings. In the former, also known as a reorganization, the business goes through a court-administered process to restructure its debts while it continues to operate. Under Chapter 7, the company closes down, and its assets are sold off.

Among the total was a surge of “mega bankruptcies,” or filings by companies with more than $1 billion in assets, during the first half of 2025. According to the economic consultancy Cornerstone Research, there were 17 such bankruptcies from January through June, the highest half-year number since the covid-19 outbreak in 2020. Consumer discretionary businesses, including retailers At Home and Forever 21, accounted for several of those filings.

Surveys have shown consumer sentiment worsening throughout the year. A widely followed survey of consumer sentiment from the University of Michigan tumbled around 28 percent year over year in November. As such, many are reticent to spend on nonessentials.

Retailers have felt this acutely, especially those selling discretionary items such as costume jewelry, crafts and furniture, which consumers often forgo to afford groceries, utilities and rent. By one estimate, Americans will spend an additional $1,800 a year because of tariffs.

Martin-Schoenberger, the KPMG economist, said the bankruptcies reflect contradictions in the economy. Government data released showed the U.S. economy grew at the fastest pace in two years from July through September, with an annualized rate of 4.3 percent.

Still, economists caution that this growth is driven by more affluent consumers and corporate spending around artificial intelligence.

“We have an economy that looks strong on paper, but that might not necessarily be reflected in every single industry,” Martin-Schoenberger said.

read more in our Telegram-channel https://t.me/The_International_Affairs

11:27 04.01.2026 •

11:27 04.01.2026 •