Europe has an even stronger ally to keep gas prices under check heading into the colder months: extremely weak demand. The manufacturing crisis that’s plaguing the continent — industrial activity in Germany has contracted for 14 consecutive months — is the best antidote against a gas supply squeeze. With friends like that, who needs enemies? – asks ‘The Washington Post’.

Europe is defeating its energy crisis thanks to the impact that said crisis has had on its industrial heartland. Across the continent, many energy-intensive companies have either closed or reduced production after not being able to cope with higher energy prices. The fertilizer, chemical, metallurgic, glass, paper and ceramic industries are particularly affected. All those shuttered factories don’t need gas or electricity now.

In Germany, activity among energy-intensive companies plunged in June by nearly 18% versus late 2020, according to official data. During the same month, industrial gas demand also declined 18% compared with a year ago. In July, gas demand posted an even deeper plunge, falling 22.9% from a year earlier, the largest decline so far in 2023. When official industrial production data is released for July in a few weeks, that drop in energy needs points to a further deterioration in industrial activity.

Due to anemic manufacturing activity and lower-than-expected gas-burn in the electricity sector, Morgan Stanley reckons that total gas demand in Europe is running about 15% below the five-year average, even when adjusted by the impact of the weather. With consumption low and LNG supply so far plentiful, Europe has been able to inject a record amount of gas into underground storage over the spring and summer — despite most countries in the region no longer having access to Russian pipeline gas supply.

European gas stocks are nearly 92% full — a record high for this time of the year. If the current injection pace continues, inventories would reach 100% by mid-September.

And yet, it would be of little solace for the continent’s industrialists. Currently, European gas prices are running at about €35 ($38) per megawatt hour, compared with the 2010-2020 average of just over €20. Wholesale electricity prices are running above €140 per megawatt hour, more than triple the 2010-2020 average of €38.5.

The real problem is that companies know that any supply issue, real or perceived, would trigger a price rally, because even with nearly full stockpiles, Europe needs all the gas it can grab to make it through the winter. The manufacturing sector remains the go-to segment of consumption to find extra demand destruction. Hence, why so many chief executive officers are reluctant to bring back production capacity, fearing reactivating a plant only to get caught again by higher prices.

As such, the price of avoiding the energy crisis is a deep recession in the manufacturing sector, and a long-term loss of economic growth.

German businesses are increasingly curbing investments and eyeing production abroad amid high energy prices at home, informs Bloomberg.

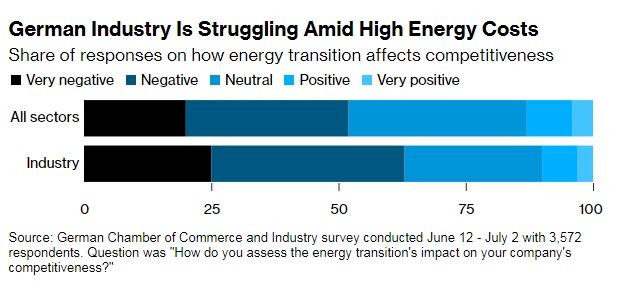

Over half of surveyed companies say the energy transition is having negative or very negative effects on their competitiveness, according to a report by the German Chamber of Commerce and Industry. Among manufacturers, almost a third are considering or already executing a production shift abroad — twice as much as during last year’s energy crisis.

“The German economy’s confidence in energy policy has fallen to a low point,” the group’s chairman Achim Dercks said. “Concerns about competitiveness have never been greater.”

Germany’s manufacturing-heavy economy has seen a protracted period of weakness that shows few signs of abating amid plunging business confidence, and it’s the only major European nation whose output is forecast to shrink this year. While manufacturers used to enjoy relatively cheap power costs when Germany was still receiving pipeline gas from Russia, last year’s crisis forced the country to revamp its plan for future supplies. Its energy prices are currently among the highest in Europe.

While the expansion of renewable energy sources is expected to eventually bring costs down, they are likely to remain elevated until at least 2027, according to the government. Among large industrial companies — who often already have links to production abroad — one in four have already started or completed further capacity movements.

read more in our Telegram-channel https://t.me/The_International_Affairs

11:25 06.09.2023 •

11:25 06.09.2023 •