It's better to seem than to be…

Economists and policymakers already worry that the growing debt pile could put upward pressure on interest rates, restraining economic growth, crowding out other priorities and potentially impairing Washington’s ability to borrow in case of a war or another crisis, writes ‘The Wall Street Journal’.

The U.S. isn’t fighting a war, a crisis or a recession. Yet the federal government is borrowing as if it were.

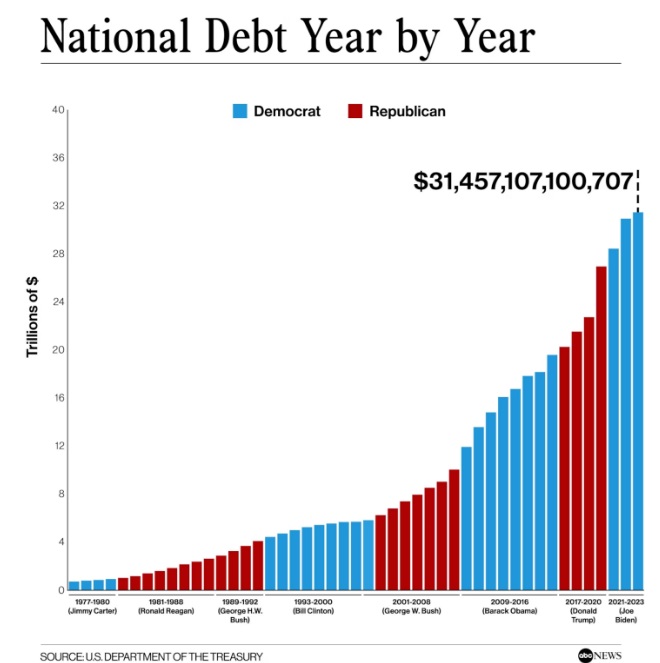

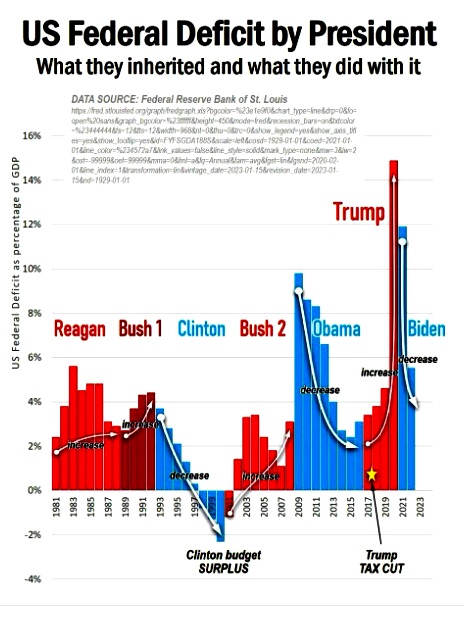

This year’s budget deficit is on track to top $1.9 trillion, or more than 6% of economic output, a threshold reached only around World War II, the 2008 financial crisis and the Covid-19 pandemic. Publicly held federal debt — the sum of all deficits — just passed $28 trillion or almost 100% of GDP.

If Congress does nothing, the total debt will climb by another $22 trillion through 2034. Interest costs alone are poised to exceed annual defense spending.

But the country’s fiscal trajectory merits only sporadic mentions by the major-party presidential nominees, let alone a serious plan to address it. Instead, the candidates are tripping over each other to make expensive promises to voters.

Economists and policymakers already worry that the growing debt pile could put upward pressure on interest rates, restraining economic growth, crowding out other priorities and potentially impairing Washington’s ability to borrow in case of a war or another crisis. There have been scattered warning signs already, including downgrades to the U.S. credit rating and lackluster demand for Treasury debt at some auctions.

Vice President Kamala Harris, the Democratic nominee, and GOP rival Donald Trump aren’t the same on fiscal policy. She has outlined or endorsed enough fiscal measures — tax increases or spending cuts — to plausibly pay for much of her agenda. He has not.

Still, both Harris and Trump were parts of administrations that helped produce those deficits. Both have promised to protect the biggest drivers of rising spending — Social Security and Medicare. And both want to extend trillions of dollars in tax cuts set to lapse at the end of 2025, amid bipartisan agreement that federal income taxes shouldn’t rise for at least 97% of households.

How did the U.S. fiscal path simultaneously become economically more alarming yet politically less relevant? Federal debt and deficits have blown past various imagined red lines and feared consequences have not materialized. Interest rates, at least until 2022, stayed low. The dollar remains the world’s reserve currency, giving the U.S. far more running room than other major countries. The U.S. of 2024 is not Greece of 2007. There is risk, but there is no fiscal crisis.

“We’ve learned we borrowed more than we realized we could,” said Jason Furman, a Harvard economist who was a top aide to President Barack Obama. “And we’ve actually borrowed more than we expected.”

Not including interest, the U.S. government will spend $1.21 for every $1.00 it collects in revenue this year. Add interest and that climbs to $1.39.

Whether markets will allow that to happen, or instead revolt, is the big unknown.

“It’s really the combination of high deficits, high debt level, high interest burden,” said Richard Francis, the lead U.S. analyst for Fitch Ratings, one of those companies. “And we didn’t see any willingness to tackle the big issues.”

At some point, maybe, the U.S. will find it difficult to borrow. At some point, interest costs may constrain policymakers. At some point, bond investors may look at the U.S. political system and decide there’s a real risk they won’t get paid back — then begin demanding higher interest rates.

For now, there’s little reason to expect a dramatic change in direction as a result of this fall’s election.

“It’s going to be a 2029, 2030 exercise,” said Schneider of Piper Sandler.

read more in our Telegram-channel https://t.me/The_International_Affairs

10:31 23.09.2024 •

10:31 23.09.2024 •